|

The focus in the November 8 week in the US was on the presidential election on Tuesday and the FOMC meeting decision on Thursday. Now that the next President has been determined, some of the uncertainty around the economy has been resolved while other elements of risk have been introduced.

The implications for Federal Reserve monetary policy have yet to be determined. As Chair Jerome Powell noted in his post-meeting press briefing, nothing changes in the near term while policymakers must wait until the new administration takes office and are in a position to enact their agenda before the information can be incorporated into the Fed’s economic models. In the meantime, FOMC participants remain dependent on the economic data and are poised to react as new numbers come in over the six weeks before the December 17-18 deliberations. At the present time, the FOMC views the risks roughly balanced between a further weakening in the labor market and a stall or uptick in inflation.

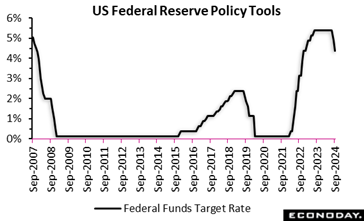

The FOMC cut the fed funds target rate range by 25 basis points to 4.50 to 4.75 percent, matching the consensus in the Econoday survey of forecasters. The FOMC took the action, "In support of its goals". The FOMC cut the fed funds target rate range by 25 basis points to 4.50 to 4.75 percent, matching the consensus in the Econoday survey of forecasters. The FOMC took the action, "In support of its goals".

In the statement, the FOMC cited a "solid" pace of expansion since the prior meeting. The statement said, "Inflation has made progress toward the Committee's 2 percent objective but remains somewhat elevated." Conditions in the labor market "generally eased, and the unemployment rate has moved up but remains low."

The latest statement left out any mention of the "greater confidence" that the FOMC had been seeking, implying that the committee is now fully confident that price stability is near relative to the 2 percent goal and that the risks have diminished. The statement said, "The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate."

Fed policymakers remain data-dependent and did not provide forward guidance beyond the repeating the recent wording of, "In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks."

Unlike the September 18 vote, the November 7 action had no dissents in the vote.

In related actions, the Board of Governors cut the discount rate by 25 basis points to 4.75 percent and lowered the interest rate paid of reserve balances to 4.65 percent. The FOMC made no change to the caps of reinvestments of US treasuries and agency mortgage-backed securities as they reduce the size of the Fed's balance sheet. The overnight repo offering rate is also reduced by 25 basis points to 4.55 percent.

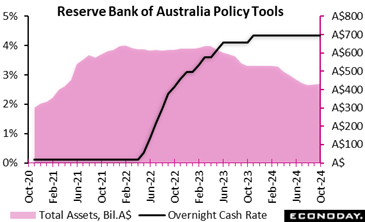

The Reserve Bank of Australia left its main policy rate, the cash rate, unchanged at 4.35 percent at its meeting today, in line with the consensus forecast. Officials increased this rate by 25 basis points in November 2023 but have since left it unchanged. Over this period, officials have noted that previous policy tightening should help return inflation to within their target range of two percent to three percent over the forecast period. The Reserve Bank of Australia left its main policy rate, the cash rate, unchanged at 4.35 percent at its meeting today, in line with the consensus forecast. Officials increased this rate by 25 basis points in November 2023 but have since left it unchanged. Over this period, officials have noted that previous policy tightening should help return inflation to within their target range of two percent to three percent over the forecast period.

In the statement accompanying today's decision, however, officials again expressed concern about the strength of price pressures. Officials noted that recent declines in headline inflation were partly driven by temporary measures, in particular government rebates for fuel and electricity, and that measures of underlying inflation remain too high.

In their Statement on Monetary Policy also published today, officials provided updated inflation forecasts. Officials now expect headline inflation to be lower in the near-term, forecasting it to fall to 2.6 percent at end-2023, compared with a previous forecast of 3.0 percent, and 2.5 percent by mid-2025, compared with the previous forecast of 2.8 percent. But forecasts further out are little changed, and officials continue to forecast headline inflation to return above the target range as the impact of temporary measures drops out before falling back within the range at end-2026.

Officials' forecasts for the trimmed mean measure of underlying inflation are little changed. This measure is forecast to fall only gradually, returning to within the target range at end-2025. Reflecting this forecast, officials concluded at today's meeting that "it will be some time yet before inflation is sustainably in the target range and approaching the midpoint".

Officials also reiterated today that returning inflation to target remains their highest priority. They advised that they are "not ruling anything in or out", implying that further rate increases could be considered if deemed necessary. Official also stressed that policy must remain "sufficiently restrictive" until they are "confident that inflation is moving sustainably towards the target range".

South Korea's headline consumer price index rose 1.3 percent on the year in October after an increase of 1.6 percent in September, below the Bank of Korea's 2.0 percent target. The index was unchanged on the month after advancing 0.1 percent previously. The fall in headline inflation was largely driven by transport prices. These fell 1.2 percent on the month after a fall of 2.0 percent previously and fell 4.0 percent on the year after a previous fall of 1.2 percent. Food price inflation also moderated from 1.8 percent to 1.4 percent. South Korea's headline consumer price index rose 1.3 percent on the year in October after an increase of 1.6 percent in September, below the Bank of Korea's 2.0 percent target. The index was unchanged on the month after advancing 0.1 percent previously. The fall in headline inflation was largely driven by transport prices. These fell 1.2 percent on the month after a fall of 2.0 percent previously and fell 4.0 percent on the year after a previous fall of 1.2 percent. Food price inflation also moderated from 1.8 percent to 1.4 percent.

Underlying price pressures also eased in October. Core CPI, excluding food and energy, rose 1.8 percent on the year, down slightly from the 2.0 percent increase recorded in September, and rose 0.2 percent on the month after a previous fall of 0.2 percent. The year-over-year increase in prices was relatively steady for most major categories of spending.

At their most recent meeting last month, officials at the BoK lowered the main policy rate by 25 basis points from 3.50 percent to 3.25 percent. In the statement accompanying that decision, officials retained their forecast for core inflation to average 2.2 percent this year and 2.0 percent in 2025 but noted uncertainties about the outlook. They also indicated that further rate cuts will be considered in upcoming meetings.

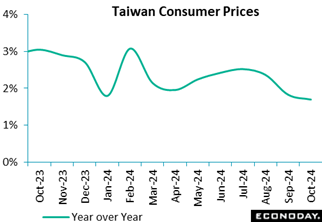

Taiwan's headline consumer price index rose 0.25 percent on the month in October after an increase of 0.11 percent in September, with the year-over-year increase moderating from 1.82 percent to 1.69 percent. Fruit prices rose strongly on the month after extreme weather events, but electricity prices fell. Core CPI, which excludes fruits, vegetables, and energy prices, increased 0.47 percent on the month in October after increasing 0.16 percent in September, with the year-over-year increase moderating from 1.79 percent to 1.64 percent. Taiwan's headline consumer price index rose 0.25 percent on the month in October after an increase of 0.11 percent in September, with the year-over-year increase moderating from 1.82 percent to 1.69 percent. Fruit prices rose strongly on the month after extreme weather events, but electricity prices fell. Core CPI, which excludes fruits, vegetables, and energy prices, increased 0.47 percent on the month in October after increasing 0.16 percent in September, with the year-over-year increase moderating from 1.79 percent to 1.64 percent.

The Central Bank of the Republic of China (Taiwan) left its main policy rate unchanged at 2.00 percent at its quarterly policy meeting mid-September. Officials remain confident that price pressures will moderate in the near-term, revising their forecast for annual headline inflation in 2024 from 2.12 percent to 2.16 percent and their forecast for annual core inflation from 2.00 percent to 1.94 percent. They expect further moderation in 2025, forecasting headline CPI inflation to fall to 1.89 percent and core CPI inflation to fall to 1.79 percent. Reflecting this assessment, officials concluded that policy settings remained appropriate. The next policy meeting will be held in December.

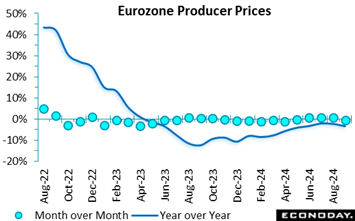

Producer prices fell in September for the first time since May. A 0.6 percent monthly drop matched the market consensus, reversed an unrevised 0.6 percent rise in August and reduced the yearly inflation rate from minus 2.3 percent to minus 3.4 percent, a 4-month low. Producer prices fell in September for the first time since May. A 0.6 percent monthly drop matched the market consensus, reversed an unrevised 0.6 percent rise in August and reduced the yearly inflation rate from minus 2.3 percent to minus 3.4 percent, a 4-month low.

However, as usual, the overall monthly change was dominated by energy where prices decreased 1.9 percent after a 1.8 percent bounce in August. Excluding this category, the PPI was only stable, leaving an essentially flat profile since June. However, with base effects quite strongly positive, this was still enough to boost the yearly core rate from 0.4 percent to 0.6 percent, extending the unbroken uptrend that began in April. Consumer goods were up 0.2 percent on the month while intermediates were unchanged and capital goods 0.1 percent softer.

The September PPI update reinforces the view that the region's pipeline pressures in manufacturing are well past their weakest point. That said, current trends remain soft and certainly no threat to the ECB's 2 percent HICP target.

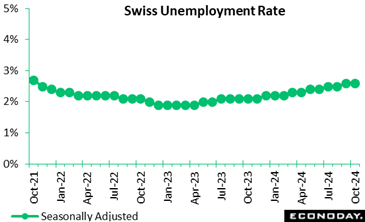

Seasonally adjusted joblessness increased by 1,771 or 1.5 percent in October to 120,936. However, this was a small enough rise to leave the unemployment rate unchanged at 2.6 percent, in line with the market consensus and matching its highest mark since September 2021. Unadjusted, the rate was also steady at 2.5 percent and still 0.5 percentage points above its level a year ago. Seasonally adjusted joblessness increased by 1,771 or 1.5 percent in October to 120,936. However, this was a small enough rise to leave the unemployment rate unchanged at 2.6 percent, in line with the market consensus and matching its highest mark since September 2021. Unadjusted, the rate was also steady at 2.5 percent and still 0.5 percentage points above its level a year ago.

Looking ahead, vacancies declined 1.6 percent on the month to 36,159, an unadjusted drop of 24.9 percent from October 2023 after a 22.4 percent fall in September.

Today's report is more pessimistic about the state of the labour market than its September counterpart and points to sluggish demand for new hires, consistent with a subdued domestic economy.

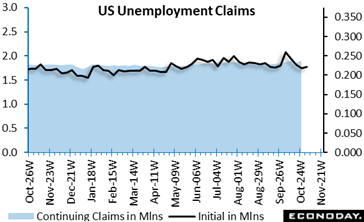

Initial jobless claims fell again, are down 15,000 in the week ending October 19 holiday week after an upward revision to 242,000 from 241,000 in the prior week. The October 19 level is nowhere near the 247,000 consensus in the Econoday survey of forecasters. The four-week moving average is up 2,000 to 238,500 in the October 19 week, after a revised 236,500 in the prior week. Initial jobless claims fell again, are down 15,000 in the week ending October 19 holiday week after an upward revision to 242,000 from 241,000 in the prior week. The October 19 level is nowhere near the 247,000 consensus in the Econoday survey of forecasters. The four-week moving average is up 2,000 to 238,500 in the October 19 week, after a revised 236,500 in the prior week.

The fall in claims was once more a surprise, with many analysts expecting an increase in filings due to Hurricane Helene and from the drawn-out strike activity at Boeing. However, seasonal factors had expected a 9,426 (or -4.2 percent) decline in unadjusted initial claims from the previous week.

There was a noticeable drop in claims filed in Georgia, New York, North Carolina, and Texas, while Florida saw the largest increase.

Insured unemployment is up 28,000 in the October 12 week to 1.897 million, after a revised 1.869 million in the prior week – further sign of the ongoing softness in the labor market. The four-week moving average is up 17,500 to 1.861 million, after 1.843 million in the October 5 week. The insured rate of unemployment remained steady at 1.2 percent in the October 12 week and has seen almost no variation since March 2023.

The initial jobless claims data continues to be volatile, moving out of step with economists' expectations. The steady upward march in the number of those who continue to receive unemployment benefits, however, underscores the difficulty many face in finding new employment. The Federal Reserve will likely focus on this aspect of the data as it tries to assess underlying developments in the labor market.

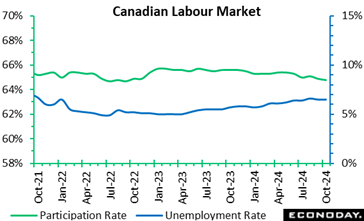

Canada's employment growth was a disappointment in October, rising by just 15,000 or a meek 0.1 percent from September, and falling short of Econoday's consensus for a 25,000 gain. Canada's employment growth was a disappointment in October, rising by just 15,000 or a meek 0.1 percent from September, and falling short of Econoday's consensus for a 25,000 gain.

The unemployment rate was unchanged at 6.5 percent in October from September. Forecasters looked for unemployment to rise to 6.6 percent in October. On a year-over-year basis, the unemployment rate was up by 0.8 percentage points in October. The unemployment rate was unchanged at 6.5 percent in October from September. Forecasters looked for unemployment to rise to 6.6 percent in October. On a year-over-year basis, the unemployment rate was up by 0.8 percentage points in October.

The data confirms the Bank of Canada's assessment in late October, when the central bank announced a 50-basis point interest rate reduction. Its statement described the labor market as "soft" while its ‘Monetary Policy Report' noted that employment growth "has been modest."

The participation rate dipped to 64.8 percent in October from 64.9 percent in September and versus 65.1 percent in August. October's drop in the participation rate was the fourth straight decline and is now at the lowest level since December 1997, excluding the pandemic years (2020 and 2021).

Total hours worked rose 0.3 percent in October and are up 1.6 percent from a year ago. Average hourly wages rebounded, rising by 4.9 percent year-over-year after the annual growth rate slowed to 4.6 percent in September from 5 percent in August.

October was the fourth straight month of relatively anemic employment growth. For October, this reflected an increase of 26,000 in full-time work, partially offset by a decline of 11,200 in part-time work.

Private sector jobs rose by just 20,500 in October after rising 61,000 in September. Public sector employment declined by 17,200 after falling by 24,000 in September and self-employment rose by 11,300 in October.

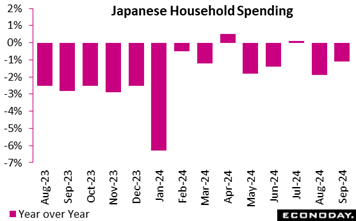

Japan's real household spending posted a smaller-than-expected 1.1% drop on year in September for a second straight decline as consumers remain frugal amid high costs for necessities, but the core measure of real average household spending (excluding housing, motor vehicles and remittance), a key indicator used in GDP calculation, eked out a slight 0.3% gain, following a similarly flat reading (-0.1%) the previous month. Japan's real household spending posted a smaller-than-expected 1.1% drop on year in September for a second straight decline as consumers remain frugal amid high costs for necessities, but the core measure of real average household spending (excluding housing, motor vehicles and remittance), a key indicator used in GDP calculation, eked out a slight 0.3% gain, following a similarly flat reading (-0.1%) the previous month.

The headline number came in firmer than the median economist forecast of a 2.5% drop and better than the high end of the forecast range (-2.9% to -1.3%). The decline was caused by volatile factors of purchases of vehicles and other released items like navigation systems as well as home maintenance and repairs (plumbing), which had a combined effect of pushing down real spending by 2.33 percentage points. Households continued eating out after the pandemic while school tuition fees (private universities) rose sharply, together lifting overall spending by 1.05 points.

On the month, real average expenditures by households with two or more people slumped 1.3% after rebounding a higher-than-forecast 2.0% in August, recovering from the 1.7% drop in July, when the heat wave had intensified. It was much weaker than the consensus call of a 0.5% dip and worse than the lowest forecast of a 1.0% fall.

In the July-September quarter, real core household spending fell 0.5% on quarter following decreases of 0.3% in April-June and 0.8% in January-March, indicating private consumption remained lackluster in the third quarter.

The median economist forecast for the preliminary Q3 GDP is a slight 0.2% rise on quarter, or an annualized 0.6%, hit by sluggish private consumption and a pullback in business investment. It would mark a sharp slowdown from a 0.7% rebound (annualized 2.9%) in Q2, when consumption and capex picked up. The GDP posted its first contraction in two quarters in Q1, hit by suspended output at Toyota group factories over a safety test scandal that had a widespread impact beyond the auto industry.

The average real income of households with salaried workers fell 1.6% in September for the first year-on-year decline in five months after rising 2.0% in August and 5.5% in July. The average real income of the primary bread earners posted its second consecutive drop, down a sharp 2.5%, while their spouses' average income marked the eighth increase in a row, up a solid 5.1%. In nominal terms, the average household income grew 1.3% following increases of 5.6% in August and 8.1% in July.

Total monthly average cash earnings per regular employee in Japan posted their 33rd straight year-on-year rise, up 2.8% in September, after rising a revised 2.8% in August, data released Thursday from the Ministry of Health, Labour and Welfare showed. Base wages rose 2.6% on year after rising a revised 2.4% the previous month.

In real terms, average wages slipped 0.1% in September after falling a revised 0.8% in August, edging up 0.3% in July and marking the first rise in 27 months in June with a 1.1% gain. To calculate real wages, the ministry uses the overall consumer price index minus the historically subdued owners' equivalent rent, which rose 2.9% on year in September.

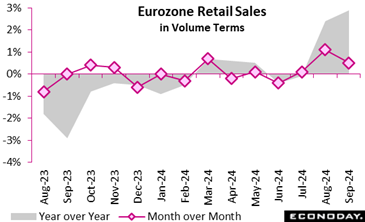

Retail sales were much stronger than expected in September. Although a 0.5 percent monthly increase was only in line with expectations, this followed a sharply upward revised 1.1 percent bounce in August that reflected the incorporation of delayed German data. Combined with additional earlier revisions, this equated with a rise in the yearly rate from 2.4 percent to 2.9 percent, more than double the market consensus. Volumes have now expanded for three months in a row Retail sales were much stronger than expected in September. Although a 0.5 percent monthly increase was only in line with expectations, this followed a sharply upward revised 1.1 percent bounce in August that reflected the incorporation of delayed German data. Combined with additional earlier revisions, this equated with a rise in the yearly rate from 2.4 percent to 2.9 percent, more than double the market consensus. Volumes have now expanded for three months in a row

Moreover, September's monthly gain was led by the non-food subsector where, excluding auto fuel, purchases were up 1.1 percent, building on an even larger 1.2 percent advance last time. Food, drink and tobacco fell 0.4 percent but auto fuel gained 0.2 percent.

Regionally, France (minus 0.5 percent) lost ground but both Germany (1.2 percent) and Spain (1.0 percent) recorded fresh increases. Elsewhere the picture was similarly mixed.

Nonetheless, the updated sales data paint a very different picture of the Eurozone retail sector than the August report. Then, overall third quarter purchases looked set to fall versus the previous period. As it is, they posted a very respectable 0.9 percent advance. This should come as some relief to the ECB which has clearly become increasingly concerned about the sluggishness of domestic demand. That said, another cut in key interest rates next month remains very likely.

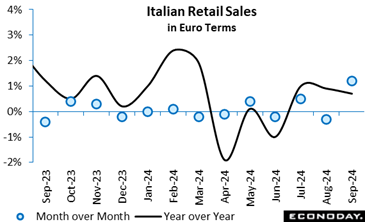

September retail sales rose a surprisingly strong 1.2 percent on the month in value, indicative of rising consumer appetite. Volumes were also up 1.2 percent, with food increasing 1.5 percent and non-food 1.1 percent. September retail sales rose a surprisingly strong 1.2 percent on the month in value, indicative of rising consumer appetite. Volumes were also up 1.2 percent, with food increasing 1.5 percent and non-food 1.1 percent.

On a yearly basis, nominal sales rose 0.7 percent and volumes 0.3 percent, partly due to gains in food (0.6 percent). Non-food volumes also increased 0.9 percent, partly due to a significant increase in sales of household appliances, radios and televisions. This offset the decrease in sales of stationary, books, newspapers and magazines seen in September.

Compared to September last year, the value of retail sales for large-scale distribution is growing. Sales outside of physical stores fell 1.6 percent, while e-commerce posted a 2.1 percent uptick. This emphasises a growing predilection for online purchasing and suggests that, despite the importance of traditional retail channels, digital platforms are becoming more critical to the development of the retail industry.

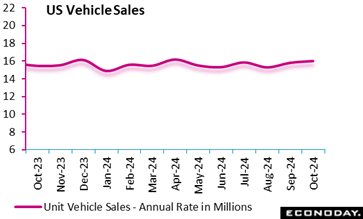

Sales of motor vehicles are up to a 16.038 million units seasonally adjusted annual pace in October after 15.768 million units in September. The pace is above the consensus of 15.800 million units for October in the Econoday survey of forecasters. Domestically produced unit sales are up to 12.380 million units in October after 12.183 million units in September. The uptick in sales likely got a boost from replacement of motor vehicles destroyed in floods associated with Hurricanes Helene and Milton. In turn, available inventories of vehicles for sales will be reduced and demand for new production should be higher. Sales of motor vehicles are up to a 16.038 million units seasonally adjusted annual pace in October after 15.768 million units in September. The pace is above the consensus of 15.800 million units for October in the Econoday survey of forecasters. Domestically produced unit sales are up to 12.380 million units in October after 12.183 million units in September. The uptick in sales likely got a boost from replacement of motor vehicles destroyed in floods associated with Hurricanes Helene and Milton. In turn, available inventories of vehicles for sales will be reduced and demand for new production should be higher.

Sales of passenger cars are up to 3.050 million units in October from 2.984 million units. Sales of light trucks – which includes minivans, SUVs, and crossover are up to 12.987 million units from 12.785 million units. Light trucks accounted for 81 percent of all units sold, similar to the trend since February.

Sales of heavy trucks – mainly to businesses moderates to 390,000 units in October from 476,000 in September. Businesses affected by the hurricanes may have yet to reopen and/or have to wait for insurance payouts before replacing equipment. If businesses are forced to shut down completely, there will be no new purchases of equipment

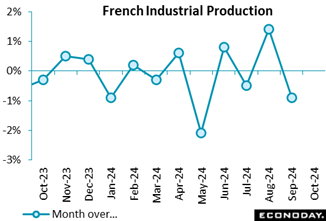

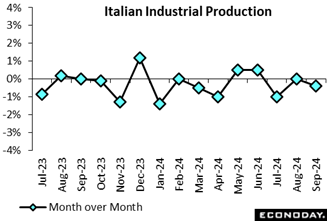

The industrial sector experienced a notable downturn in September, with monthly output dropping by 0.9 percent after a revised rise of 1.1 percent in August. The decline, slightly steeper than the consensus, was led by a significant fall in pharmaceutical production, which plunged 11.7 percent following high output in the prior month. Key sectors such as mining, quarrying, and energy declined, alongside machinery and equipment manufacturing, which underscored a broader industrial slowdown. The industrial sector experienced a notable downturn in September, with monthly output dropping by 0.9 percent after a revised rise of 1.1 percent in August. The decline, slightly steeper than the consensus, was led by a significant fall in pharmaceutical production, which plunged 11.7 percent following high output in the prior month. Key sectors such as mining, quarrying, and energy declined, alongside machinery and equipment manufacturing, which underscored a broader industrial slowdown.

However, some sectors showed resilience. Food products, beverages, and coke/refined petroleum products rebounded, with transport equipment also showing modest gains. Yearly data paints a similar picture, with an overall industrial output decline of 0.6 percent, driven by declines in transport equipment, machinery, and energy-intensive industries. Energy costs have particularly burdened energy-intensive industries, with substantial output drops in sectors like steel, glass, and chemicals compared to pre-energy price hikes in 2021.

This trend suggests that elevated production costs continue to strain energy-dependent industries, affecting overall industrial productivity.

Germany's manufacturing sector showed a notable rebound in new orders in September, rising by 4.2 percent from August. The rebound only followed a revised 5.4 percent slump in August but there are signs of a recovery in demand. Notably, this growth is driven by substantial gains in specific sectors: the manufacture of transport equipment surged by 117.1 percent, spurred by large-scale orders in aircraft, ships, and military vehicles, while the automotive industry rose by 2.9 percent. However, challenges persist, with sectors like basic metals and machinery declining by 10.0 percent and 3.6 percent, respectively. Germany's manufacturing sector showed a notable rebound in new orders in September, rising by 4.2 percent from August. The rebound only followed a revised 5.4 percent slump in August but there are signs of a recovery in demand. Notably, this growth is driven by substantial gains in specific sectors: the manufacture of transport equipment surged by 117.1 percent, spurred by large-scale orders in aircraft, ships, and military vehicles, while the automotive industry rose by 2.9 percent. However, challenges persist, with sectors like basic metals and machinery declining by 10.0 percent and 3.6 percent, respectively.

Domestic demand was strong, with a 3.6 percent increase and was supported by a 4.4 percent rise in foreign orders. Orders from the euro area climbed by an impressive 14.6 percent, though orders from non-euro countries fell by 1.6 percent. By type, capital goods rose sharply by 8.3 percent, signalling robust business investments, while consumer goods orders grew by 3.8 percent, and intermediate goods fell by 2.4 percent.

Germany's industrial production took a sharp downturn in September, declining by a much steeper than expected 2.5 percent month-over-month and 4.6 percent year-over-year. This slump reversed the revised 2.6 percent growth recorded in August. A broader view shows a 1.9 percent drop over the last three months, confirming underlying weakness. Germany's industrial production took a sharp downturn in September, declining by a much steeper than expected 2.5 percent month-over-month and 4.6 percent year-over-year. This slump reversed the revised 2.6 percent growth recorded in August. A broader view shows a 1.9 percent drop over the last three months, confirming underlying weakness.

The automotive industry experienced a dramatic 7.8 percent decline in September, erasing much of the 15.4 percent gain from August. This sector's volatility continues to influence overall industrial performance. Similarly, the chemical industry contracted by 4.3 percent, further weighing on output. However, machinery and equipment production bucked the trend, rising by 1.7 percent. Across all major industrial categories, production faltered. Capital goods fell by 4.0 percent, while intermediate and consumer goods declined by 1.6 percent and 1.4 percent respectively. Even outside manufacturing, energy and construction output shrank by 2.1 percent and 1.4 percent.

Year-over-year, industrial production excluding energy and construction was 5.2 percent lower, highlighting a widespread slowdown. With declines across key sectors, Germany's industrial recovery faces headwinds, underscoring the need for strategic interventions to stabilize output in the months ahead.

Industrial production fell 0.4 percent on the month in September, undershooting expectations. Although capital goods and intermediate rose 1.8 percent and 1.9 percent respectively, this was offset by a decline in energy (3.8 percent) and consumer goods (2.5 percent). Industrial production fell 0.4 percent on the month in September, undershooting expectations. Although capital goods and intermediate rose 1.8 percent and 1.9 percent respectively, this was offset by a decline in energy (3.8 percent) and consumer goods (2.5 percent).

Year-over-year, intermediate goods and capital goods were particularly weak with falls of 4.0 percent and 5.1 percent respectively, making for a headline drop of 4.0 percent. Energy also fell 1.6 percent.

In sum, goods production deteriorated more sharply than expected in September and, having contracted a quarterly 0.6 percent, subtracted from GDP growth for a sixth successive quarter.

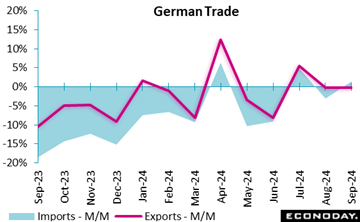

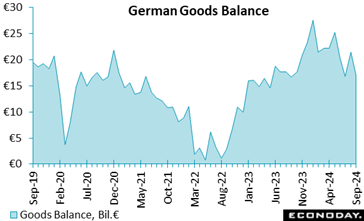

Germany's trade dynamics showed mixed trends in September 2024. Exports slipped by 1.7 percent compared to August, totalling €128.2 billion, while imports climbed by 2.1 percent to €111.3 billion. This narrowed the trade surplus to a smaller than expected €17.0 billion, a notable drop from €21.4 billion the previous month. Year-over-year, exports dipped slightly by 0.2 percent, while imports rose 1.4 percent. Germany's trade dynamics showed mixed trends in September 2024. Exports slipped by 1.7 percent compared to August, totalling €128.2 billion, while imports climbed by 2.1 percent to €111.3 billion. This narrowed the trade surplus to a smaller than expected €17.0 billion, a notable drop from €21.4 billion the previous month. Year-over-year, exports dipped slightly by 0.2 percent, while imports rose 1.4 percent.

Trade with EU partners reflected these shifts, with exports down 1.8 percent and imports up 1.6 percent. The Eurozone saw a sharper 2.4 percent decline in German exports. Meanwhile, trade with non-EU nations presented a similar pattern: exports fell by 1.6 percent, but imports surged by 2.6 percent. The US remained a bright spot, with German exports growing by 4.8 percent to €14.2 billion, underscoring strong transatlantic demand. However, exports to China and the UK contracted significantly, falling by 3.7 percent and 4.9 percent, respectively. On the import side, China solidified its position as Germany's top supplier, with imports up 5.6 percent to €14.1 billion.

Despite some challenges, Germany's trade figures underline its resilience amid shifting global demand and geopolitical complexities. However, the narrowing surplus signals potential headwinds in maintaining a favourable trade balance.

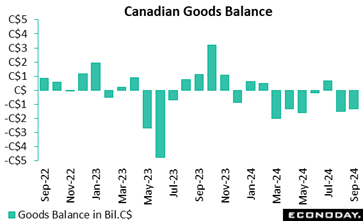

Canada's merchandise trade deficit in September narrowed to -C$1.3 billion from a revised –C$1.5 billion in August (previously –C$1.1 billion), compared to a -C$0.5 billion consensus in the Econoday survey of forecasters. Exports decreased 0.1 percent, after a 1.4 percent drop in August, while imports fell 0.4 percent - almost reversing a 0.5 percent increase in August. Canada's merchandise trade deficit in September narrowed to -C$1.3 billion from a revised –C$1.5 billion in August (previously –C$1.1 billion), compared to a -C$0.5 billion consensus in the Econoday survey of forecasters. Exports decreased 0.1 percent, after a 1.4 percent drop in August, while imports fell 0.4 percent - almost reversing a 0.5 percent increase in August.

This is the third straight drop in Canada goods exports, with Statscan reporting that lower prices were behind the decline in ‘nominal' exports, but when adjusted for inflation, total exports rose 1.4 percent. In real terms, imports were "essentially unchanged."

Exports are down 2.8 percent compared to September 2023, while imports rose by just 0.2 percent.

On a quarterly basis, after a 0.3 percent increase in the second quarter, exports dropped 0.2 percent in the third quarter. The decline in exports of motor vehicles and parts (-3.8 percent) was the primary driver of the quarterly decrease.

Meanwhile, imports dipped by 0.1 percent in the third quarter. After a strong showing in the second quarter, a plunge in the imports of motor vehicles and parts (-6 percent) was the largest contributor to the decline.

As a result, Canada's quarterly merchandise trade deficit increased from -C$2.8 billion in the second quarter to -C$3.0 billion in the third quarter.

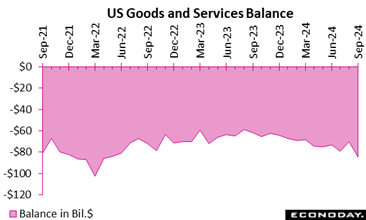

July gets third-quarter net exports off on the back foot. The goods and services deficit swelled to an as-expected $78.8 billion from June's $73.0 billion as a 0.5 percent gain in exports to $266.6 billion was dwarfed by a 2.1 percent jump in services to $345.4 billion. July gets third-quarter net exports off on the back foot. The goods and services deficit swelled to an as-expected $78.8 billion from June's $73.0 billion as a 0.5 percent gain in exports to $266.6 billion was dwarfed by a 2.1 percent jump in services to $345.4 billion.

The goods deficit swelled by $5.6 billion in July to $103.1 billion while the offsetting surplus in services came to only $0.2 billion at $24.3 billion. For goods, exports of vehicles and parts fell $1.7 billion with passenger cars down $1.3 billion; exports of consumer goods fell $0.8 billion with gem diamonds down $0.7 billion; exports of capital goods, however, rose $1.8 billion with semiconductors up $1.7 billion. For services, exports rose $0.6 billion to $91.5 billion led by financial services up $0.2 billion in the month.

Turning to imports, capital goods rose $3.3 billion driven by a $2.4 billion increase in computer accessories (though a negative for the trade balance, rising imports of capital goods are a positive for US business investment and productivity). Imports of industrial supplies rose $2.8 billion that included a $1.1 billion rise in nonmonetary gold. Looking at imports of services, charges for intellectual property rose $0.5 billion with transport up $0.3 billion and travel down $0.3 billion.

Net exports of goods and services pulled GDP lower in both the first and second quarters this year with, following July's results, a third straight quarter of trouble in the works.

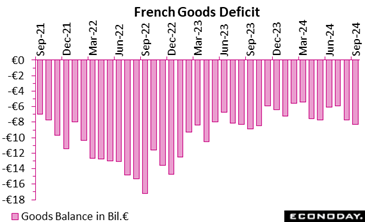

France's trade dynamics painted a mixed picture of economic shifts in September. The trade deficit expanded sharply to €8.27 billion, driven by a €0.5 billion surge in imports and a €0.2 billion dip in exports. This imbalance underscores a growing dependency on foreign goods amidst a backdrop of weakening export performance. France's trade dynamics painted a mixed picture of economic shifts in September. The trade deficit expanded sharply to €8.27 billion, driven by a €0.5 billion surge in imports and a €0.2 billion dip in exports. This imbalance underscores a growing dependency on foreign goods amidst a backdrop of weakening export performance.

The energy balance showed resilience, declining marginally by €0.1 billion, reflecting stability in energy-related transactions. However, the capital goods sector experienced a significant setback, with its balance plunging by €0.6 billion, signalling weaker industrial investment or competitiveness.

On a positive note, the intermediate and consumer goods sectors offered glimmers of hope, each recovering by €0.1 billion. Notably, the consumer goods balance stabilised after months of decline, suggesting a potential rebound in domestic production or demand alignment.

Overall, the data highlights structural challenges in France's external trade, particularly in capital goods, while modest gains in consumer and intermediate goods hint at areas of resilience.

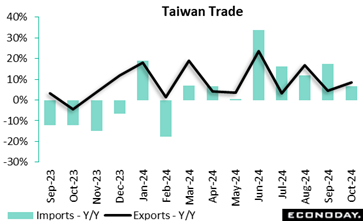

Taiwan's trade surplus narrowed from $7.12 billion in September to $6.87 billion in October. Exports rose 8.4 percent after increasing 4.5 percent previously, while imports rose 6.5 percent after a previous increase of 17.3 percent. Taiwan's trade surplus narrowed from $7.12 billion in September to $6.87 billion in October. Exports rose 8.4 percent after increasing 4.5 percent previously, while imports rose 6.5 percent after a previous increase of 17.3 percent.

The increase in headline growth in exports was parlty driven stronger growth in exports of information, communication and audio-video products, up 28.0 percent on the year after advancing 24.8 percent previously, with year-over-year growth in exports of electronic components picking up from 4.9 percent to 6.1 percent. Exports to the United States increased 20.5 percent on the year, while exports to mainland China and Hong Kong fell 2.1 percent. Petroleum imports fell 31.6 percent on the year, while imports from mainland China and Hong Kong fell 5.1 percent. The increase in headline growth in exports was parlty driven stronger growth in exports of information, communication and audio-video products, up 28.0 percent on the year after advancing 24.8 percent previously, with year-over-year growth in exports of electronic components picking up from 4.9 percent to 6.1 percent. Exports to the United States increased 20.5 percent on the year, while exports to mainland China and Hong Kong fell 2.1 percent. Petroleum imports fell 31.6 percent on the year, while imports from mainland China and Hong Kong fell 5.1 percent.

China's trade surplus in US dollar terms widened to $95.27 billion in October from $81.71 billion in September. Exports rose 12.7 percent on the year in October after increasing 2.4 percent in September, while imports fell 2.3 percent on the year after a previous increase of 0.3 percent. China's trade surplus in US dollar terms widened to $95.27 billion in October from $81.71 billion in September. Exports rose 12.7 percent on the year in October after increasing 2.4 percent in September, while imports fell 2.3 percent on the year after a previous increase of 0.3 percent.

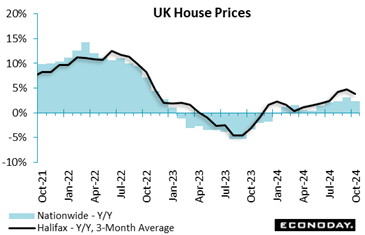

House prices rose again in October but more slowly than expected and by less than in September. A 0.1 percent monthly rise in the Nationwide's index was a couple of ticks below the the market consensus and well down on the previous period's slightly weaker revised 0.6 percent advance. With base effects negative, annual inflation cooled from 3.2 percent to 2.4 percent and prices remain about 2 percent below their all-time highs recorded in summer 2022. House prices rose again in October but more slowly than expected and by less than in September. A 0.1 percent monthly rise in the Nationwide's index was a couple of ticks below the the market consensus and well down on the previous period's slightly weaker revised 0.6 percent advance. With base effects negative, annual inflation cooled from 3.2 percent to 2.4 percent and prices remain about 2 percent below their all-time highs recorded in summer 2022.

Even so, the 3-monthly change only dipped 0.1 percentage point and, at 0.6 percent, suggests that the market still has decent momentum. The labour market is strong, real earnings growth accelerating and mortgage approvals are approaching pre-pandemic levels. However, the forthcoming reduction to nil rate stamp duty threshold and higher stamp duty rate on second homes announced in the Budget may cloud the medium-term outlook while providing a boost to short-term activity.

According to the Halifax house price index, the UK housing market hit a milestone in October, with the average house price climbing to a record £293,999. This represents a modest monthly increase of 0.2 percent, matching consensus estimates and an annual growth of 3.9 percent, marking a slowdown from September's revised 4.6 percent. Despite higher interest rates, house prices have demonstrated resilience, reflecting a significant shift from the rapid 21 percent growth during the pandemic boom. Northern Ireland remains a standout performer, with the highest annual price growth in the UK.

Mortgage activity is on the rise, bolstered by falling rates - down over 160 basis points since summer - and sustained income growth. However, affordability challenges persist. Borrowing constraints may tighten as markets anticipate slower rate cuts from the Bank of England. Policy shifts, such as increased stamp duty for second homes, could temper demand further.

Looking forward, house prices are expected to maintain a subdued upward trend, reflecting a delicate balance between improving affordability and ongoing economic pressures. This suggests a steady but cautious market recovery into 2024.

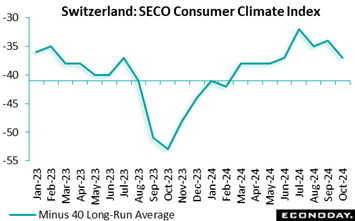

Consumer sentiment deteriorated at the start of the quarter. At minus 37, October's unadjusted headline index was down 3 points versus September and at a 5-month low. However, it was still some 16 points stronger than a year ago and also well above its minus 40 long-run average. Consumer sentiment deteriorated at the start of the quarter. At minus 37, October's unadjusted headline index was down 3 points versus September and at a 5-month low. However, it was still some 16 points stronger than a year ago and also well above its minus 40 long-run average.

The monthly drop was largely due to a markedly worse economic outlook (minus 30 after minus 19) although at least in part the decline here was probably seasonal. Spending intentions (minus 32 after minus 29) were also softer but most other areas of the survey showed little change. Of note for the SNB, 1-year ahead inflation expectations (99 after 95) moved off the previous period's record low.

Today's report leaves a fairly flat underlying trend in consumer confidence, potentially pointing to a modest increase in spending this quarter and should not deter the SNB from easing again next month.

The S&P Global India manufacturing PMI indicates activity in the sector strengthened further in October, with the headline index increasing to 57.5 from an eight-month low of 56.5 in September. This is just above the flash estimate of 57.4. Less timely industrial production data published last month showed weaker conditions in the manufacturing sector in August, with September data scheduled to be published mid-November. The S&P Global India manufacturing PMI indicates activity in the sector strengthened further in October, with the headline index increasing to 57.5 from an eight-month low of 56.5 in September. This is just above the flash estimate of 57.4. Less timely industrial production data published last month showed weaker conditions in the manufacturing sector in August, with September data scheduled to be published mid-November.

PMI survey respondents reported stronger growth in output, new orders and new export orders in October. The survey also shows a bigger increase in payrolls while its measure of business confidence also rebounded from a previous decline. Respondents reported stronger growth in input costs and a solid increase in selling prices.

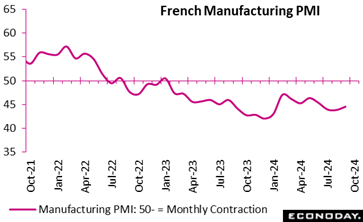

The updated PMI report highlights an accelerated downturn in France's manufacturing sector as the final quarter of 2024 began. October's final PMI score of 44.5 was in line with its flash estimate and down a tick from September's final print. A significant drop in new orders, largely driven by weak international demand, led to the steepest production fall since January. The updated PMI report highlights an accelerated downturn in France's manufacturing sector as the final quarter of 2024 began. October's final PMI score of 44.5 was in line with its flash estimate and down a tick from September's final print. A significant drop in new orders, largely driven by weak international demand, led to the steepest production fall since January.

Export orders saw one of their sharpest declines on record, attributed to geopolitical issues and a fragile global economy. Manufacturing retrenchment is evident across employment, inventory management, and purchasing activity, with firms anticipating continued contraction over the next year. Intermediate and investment goods were hit hardest, although consumer goods saw a minor rise. Input costs fell for the first time since March, yet companies maintained stable prices for clients, reflecting caution in market dynamics.

Overall, the report underscores manufacturers' pessimism and an ongoing struggle to balance inventory and workforce amid uncertain demand and economic pressures.

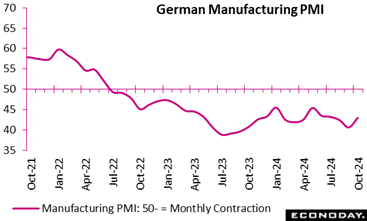

The final manufacturing PMI report reveals a slight easing in Germany's manufacturing downturn last month, though the sector remains firmly in contraction. The PMI rose to 43.0, slightly above the 42.6 flash estimate, September's final 40.6 and a 3-month high. There were smaller declines in output, new orders, and employment. However, intense competition led firms to cut output prices further, as companies sought to secure limited demand by passing on cost savings from lower input prices. While production and new orders continued to fall, the pace of contraction lessened, especially in international sales, which recorded the least significant drop in five months. The final manufacturing PMI report reveals a slight easing in Germany's manufacturing downturn last month, though the sector remains firmly in contraction. The PMI rose to 43.0, slightly above the 42.6 flash estimate, September's final 40.6 and a 3-month high. There were smaller declines in output, new orders, and employment. However, intense competition led firms to cut output prices further, as companies sought to secure limited demand by passing on cost savings from lower input prices. While production and new orders continued to fall, the pace of contraction lessened, especially in international sales, which recorded the least significant drop in five months.

Even so, stock depletion and employment cuts persisted, with businesses remaining cautious amidst economic and political uncertainty, compounded by challenges in the automotive and construction sectors.

Looking ahead, confidence remains low, although there was a slight improvement in outlook compared to September.

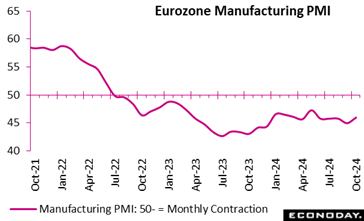

Manufacturing activity deteriorated in October. At 46.0, the final PMI was just 0.1 point above its lowly flash estimate, 1.0 point stronger than its final September mark and fully 4 points below the 50-expansion threshold. Manufacturing activity deteriorated in October. At 46.0, the final PMI was just 0.1 point above its lowly flash estimate, 1.0 point stronger than its final September mark and fully 4 points below the 50-expansion threshold.

The best-performing countries were Spain (54.5), Ireland (51.5) and Greece (51.2) where growth was at least positive. However, the Netherlands (47.0), Italy (46.9), France (44.5), Germany (43.0) and Austria (42.0) all saw fresh contractions. In particular, Austria recorded its weakest performance in 10 months.

October's setback reflects the 28th month in a row in which the manufacturing economy deteriorated, marking the longest downturn on record. Weakness in region was again mainly attributable to its two largest economies, Germany and France, where contractions were particularly severe. Factory output for the Eurozone declined while employment also fell due to worsening business confidence.

Input costs also decreased in October, leading to discounts as firms responded by trimming factory gate prices.

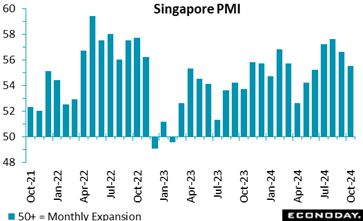

The S&P Global Singapore PMI survey indicates growth in the aggregate economy remained strong but moderated in October, with the survey's headline index falling to 55.5 from 56.6 in September. Respondents reported ongoing strength in current conditions, stronger optimism about the outlook, and an acceleration in price pressures. The S&P Global Singapore PMI survey indicates growth in the aggregate economy remained strong but moderated in October, with the survey's headline index falling to 55.5 from 56.6 in September. Respondents reported ongoing strength in current conditions, stronger optimism about the outlook, and an acceleration in price pressures.

Today's survey shows output rose at strong but slightly less pronounced pace in October, but respondents also reported stronger new orders and another increase in payrolls. The survey's measure of business confidence rose to its second-highest level in three years, just below the level recorded in August. Respondents also reported the biggest increases in both input costs and selling prices since early in the year.

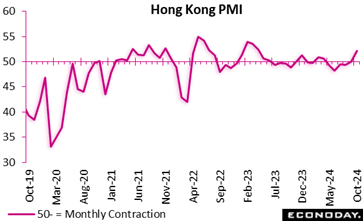

The S&P Global Hong Kong PMI survey indicates that Hong Kong's economy returned to expansion in October after five months of no growth. The headline index rose to 52.2 from 50.0 in September, with the survey showing improvement in current conditions. The S&P Global Hong Kong PMI survey indicates that Hong Kong's economy returned to expansion in October after five months of no growth. The headline index rose to 52.2 from 50.0 in September, with the survey showing improvement in current conditions.

Survey respondents reported output, new orders and new export orders all rose in October after falling in September. Payrolls were reported to have been reduced for the sixth consecutive month, and the survey's measure of business confidence rose but continues to indicate that firms expect output to fall over the next twelve months. The survey shows a bigger increase in input costs but a smaller increase in selling prices.

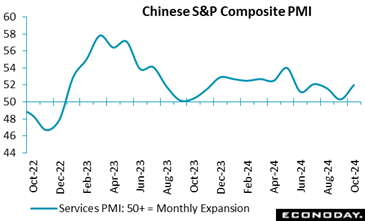

The S&P Global PMI composite index for China rose to a four-month high of 51.9 in October from 50.3 in September, indicating that the Chinese economy has gained some momentum after officials delivered policy measures aimed at boosting growth late September. The business activity index for China's services sector rose to 52.0 from 50.3, while the headline index for the manufacturing PMI survey, published last week, indicated renewed expansion in the sector. Official PMI survey data, meanwhile, showed slightly stronger conditions in both the manufacturing and the non-manufacturing sector in October. The S&P Global PMI composite index for China rose to a four-month high of 51.9 in October from 50.3 in September, indicating that the Chinese economy has gained some momentum after officials delivered policy measures aimed at boosting growth late September. The business activity index for China's services sector rose to 52.0 from 50.3, while the headline index for the manufacturing PMI survey, published last week, indicated renewed expansion in the sector. Official PMI survey data, meanwhile, showed slightly stronger conditions in both the manufacturing and the non-manufacturing sector in October.

Respondents to today's service sector survey reported stronger growth in output, new orders, and new export orders in October. The survey showed a second consecutive increase in payrolls while its measure of confidence rose to its highest level since May. Respondents also reported slower growth in input costs and no change in selling prices after two months of declines.

Today's data were much stronger than the consensus forecast of 50.5 for the service sector survey's headline index.

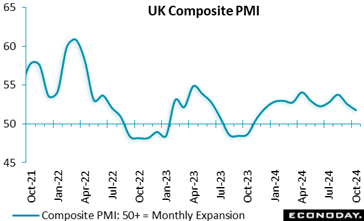

The final composite output index rose to 51.8, up from the flash estimate of 51.7, but down from September's final 52.6 and its lowest print since November 2023. While the latter half of October performed slightly better than the earlier half, there has still been a slowdown in the rate of expansion in private-sector economic activity. This is reflected in a smaller increase in new orders, a modest decline in employment and an easing in input cost inflation on the back of much softer cost pressures in the manufacturing sector. The final composite output index rose to 51.8, up from the flash estimate of 51.7, but down from September's final 52.6 and its lowest print since November 2023. While the latter half of October performed slightly better than the earlier half, there has still been a slowdown in the rate of expansion in private-sector economic activity. This is reflected in a smaller increase in new orders, a modest decline in employment and an easing in input cost inflation on the back of much softer cost pressures in the manufacturing sector.

The service sector index rose to a final 52.0, up from the 51.8 flash estimate but down from September's final 52.4. As seen in the composite index, the latter half of the month saw services modestly outperform the earlier half but, compared to September, monthly growth was still slower.

Demand continued to rise but cautious decision-making among clients was partly due to uncertainty ahead of the Autumn Budget on 30th October which delayed spending decisions. Geopolitical tensions also affected the willingness to spend. Employment growth slowed noticeably with rising wage costs cited as a key factor. Surprisingly service providers often noted stronger demand from EU clients, despite the ongoing trade frictions due to Brexit.

Employment remained a relatively weak spot in October with staffing numbers declining for the first time since December 2023.

Input cost inflation edged up to a three-month high, while the rate of output price inflation picked up from September's 43-month low. Uncertainty ahead of the Autumn Budget dampened business confidence and optimism dropped to the lowest in four months.

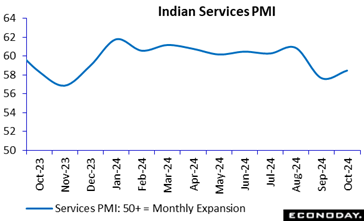

The S&P Global PMI survey for India's services sector shows conditions strengthened further in October, with the survey's main business activity index increasing to 58.5 in October from 57.7 in September. This compares with the flash estimate of 57.9. The manufacturing sector PMI, published earlier in the week, also showed stronger conditions, with its headline index increasing from 56.5 to 57.5. The composite index covering both sectors rose from 58.3 in September to 59.1 in October, above the flash estimate of 58.3. With these PMI surveys still showing very robust conditions in the Indian economy, the Reserve Bank of India's focus will likely remain on risks to the inflation outlook at upcoming policy meetings. The S&P Global PMI survey for India's services sector shows conditions strengthened further in October, with the survey's main business activity index increasing to 58.5 in October from 57.7 in September. This compares with the flash estimate of 57.9. The manufacturing sector PMI, published earlier in the week, also showed stronger conditions, with its headline index increasing from 56.5 to 57.5. The composite index covering both sectors rose from 58.3 in September to 59.1 in October, above the flash estimate of 58.3. With these PMI surveys still showing very robust conditions in the Indian economy, the Reserve Bank of India's focus will likely remain on risks to the inflation outlook at upcoming policy meetings.

Respondents to the service sector survey reported output, new orders and new export orders all continued to grow at a very strong pace in October and at a pace stronger than recorded in September. The survey also shows a bigger increase in payrolls while its measure of business confidence remains high but eased slightly from the previous months. Respondents reported a bigger increase in both input costs and selling prices.

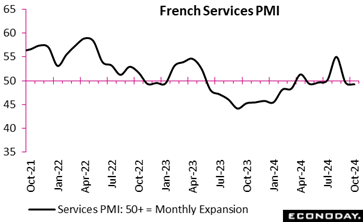

France's service sector contracted modestly in October, despite the flash services PMI being revised up to 49.2, a 7-month low. The final composite PMI output index was also revised up to 48.1 but similarly remained short of the 50-growth threshold. Weakening demand drove the decline, as new business orders fell at the fastest pace since January, with both domestic and foreign sales shrinking. Export business saw its steepest drop in five months, contributing to reduced client numbers and lower footfall. France's service sector contracted modestly in October, despite the flash services PMI being revised up to 49.2, a 7-month low. The final composite PMI output index was also revised up to 48.1 but similarly remained short of the 50-growth threshold. Weakening demand drove the decline, as new business orders fell at the fastest pace since January, with both domestic and foreign sales shrinking. Export business saw its steepest drop in five months, contributing to reduced client numbers and lower footfall.

Labour market activity slowed, with firms hesitant to hire. Fixed-term contracts were added in some cases, but many temporary contracts went unrenewed. Business confidence weakened, with firms anticipating fewer customers and heightened competition in the coming months.

Despite muted cost pressures, service providers marginally raised prices in October, primarily to address salary expenses. However, input price inflation remained near a multi-year low, reflecting tight cost management. This delicate balance aims to cushion financial pressures without further dampening demand.

October's data highlights a tough start to Q4, with shrinking demand and subdued business sentiment signaling continued challenges for France's service sector.

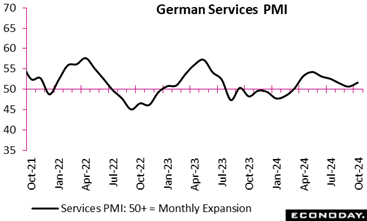

Germany's services sector saw a modest recovery in October 2024, with the flash services PMI revised up to a final 51.6, a three-month high. The flash composite PMI was also revised firmer to 48.6 but remained below the 50-growth threshold. Weak underlying demand persisted, as new business orders fell for a second month, weighed down by sluggish manufacturing, fewer public sector opportunities, and declining international demand, particularly from Europe. Germany's services sector saw a modest recovery in October 2024, with the flash services PMI revised up to a final 51.6, a three-month high. The flash composite PMI was also revised firmer to 48.6 but remained below the 50-growth threshold. Weak underlying demand persisted, as new business orders fell for a second month, weighed down by sluggish manufacturing, fewer public sector opportunities, and declining international demand, particularly from Europe.

While firms cleared backlogs to support activity, reduced incoming work led to job cuts for the fourth consecutive month, marking the longest period of employment decline since early 2020. Wage increases caused a slight uptick in cost pressures, but overall inflation remained near multi-year lows. Service providers raised prices cautiously, with output price inflation at one of its slowest rates since April 2021.

Growth expectations improved slightly from September's low, buoyed by hopes of lower inflation and new product launches. However, optimism remained historically muted due to ongoing economic uncertainties.

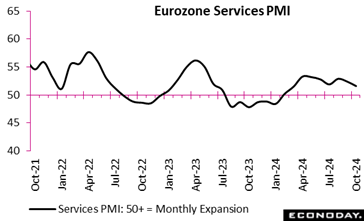

At 50.0 the final PMI composite index for October signalled no change in business activity. It was 0.4 points above its September print and 0.3 points stronger than its flash estimate. At 50.0 the final PMI composite index for October signalled no change in business activity. It was 0.4 points above its September print and 0.3 points stronger than its flash estimate.

At the national level, the best-performing countries were Spain (55.2) and Ireland (52.6), Italy (51.0) all of which saw an expansion of business activities. The weaker performing countries were Germany (48.6) and France (48.1), both of which fell short of the 50-growth threshold, signalling contraction. The decline of Germany and France offset the growth seen in the other countries.

The final service PMI for September was 51.6, above both the flash estimate (51.2) and final September mark (51.4) and signalling a modest expansion. Even so, new business decreased for the second time in a row with the fall in new business from abroad being the sharpest in the last 10 months. Outstanding orders were run down to support activity and employment continued to rise. Services input costs and output charges continued to increase, although rates of inflation held close to the lows seen in September.

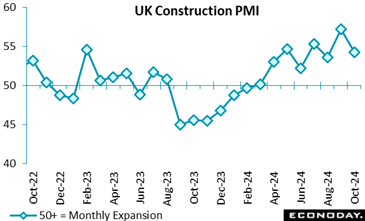

Growth of construction activity slowed in October, with the PMI falling slightly below forecast to 54.3 from September's 57.2. Despite the deceleration, the index remained above the 50.0 threshold, signalling continued expansion for the eighth month. Civil engineering performed best (56.2), driven by demand for energy infrastructure projects. Commercial work also expanded (52.8), albeit at a slower rate, while house building saw a slight contraction (49.4) due to elevated borrowing costs and Autumn Budget uncertainties. Growth of construction activity slowed in October, with the PMI falling slightly below forecast to 54.3 from September's 57.2. Despite the deceleration, the index remained above the 50.0 threshold, signalling continued expansion for the eighth month. Civil engineering performed best (56.2), driven by demand for energy infrastructure projects. Commercial work also expanded (52.8), albeit at a slower rate, while house building saw a slight contraction (49.4) due to elevated borrowing costs and Autumn Budget uncertainties.

New orders grew solidly but did not match September's highs, constrained by political and cost-of-living pressures. Firms reported robust sales pipelines and tender opportunities, indicating an improving economic environment. Employment increased by the most in three months as businesses boosted hiring to meet demand.

Input costs rose due to higher raw material prices, though inflation eased compared to September. Supplier delivery times improved for the third month, though some firms cited international shipping disruptions. Business optimism deteriorated to its lowest in 10 months, with concerns about economic and political uncertainties weighing on future growth prospects.

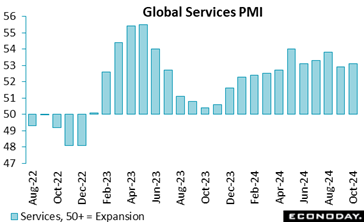

The global composite index for October rose to 52.3, 0.4 points more than September (51.9). This is the 12th month in a row that the global composite is above 50, signalling business expansion. The global composite index for October rose to 52.3, 0.4 points more than September (51.9). This is the 12th month in a row that the global composite is above 50, signalling business expansion.

The composite index saw an increase in new business (51.6) with emerging markets showing broad-based expansion with India and Brazil at the top of the growth rankings. China and Russia also saw output increase. Among major developed nations, the US registered the strongest rate of expansion. In the Eurozone area output stabilised while the UK saw moderate growth. Japan contracted for the first time in four months.

The global service index rose to 53.1, 0.2 points higher than in September (52.9) and extending a 21-month streak of expansion. This can be attributed to growth in both new orders (52.7) and new export business (50.7). Employment increased slightly while backlogs made gains. Input prices rose again in September, with the rate of inflation remaining high, leading to an increase in output prices.

Global employment fell with staffing levels decreasing in the US, China, Eurozone area and the UK.

Input price inflation eased to an eight-month low, while output charges rose at the slowest pace seen in four years.

After having fallen to a near-two-year low in September, future expectations rose in October to the highest since May.

The Global economy is still outpacing market expectations.

Econoday’s Relative Economic Performance Index (RPI) closed out last week at 30, showing global economic activity running quite well ahead of market forecasts. Although the U.S. index remained close to zero and its Canadian counterpart moved deeper into negative territory, the Eurozone and, in particular, China continued to outperform.

In the U.S., the RPI and RPI-P both ended the period little changed at 1, indicating that the overall economy is essentially matching expectations. The latest readings duly support the Federal Reserve’s decision to cut interest rates by just 25 basis points.

In Canada, the labour market proved a little softer than anticipated in October and trimmed the RPI to minus 30 and the RPI-P to minus 24. Economic activity in general, and inflation in particular, continue to favour another cut in Bank of Canada interest rates in December.

In the Eurozone, the RPI (18) and RPI-P (8) lost a little ground but remained in positive surprise territory with Germany (RPI 21) extending its period of outperformance. The region’s overall economic activity is running slightly ahead of market expectations, but not to the extent that would prevent another 25 basis point ease by the European Central Bank next month.

In the UK, the data was again mainly on the soft side of forecasts. With the RPI at now minus 25 and the RPI-P at minus 30, the latest reports provide additional justification for the widely expected cut in Bank Rate.

In Switzerland, October’s labour market lived up to expectations, but surprisingly soft consumer confidence ensured that the RPI (minus 31) and RPI-P (minus 25) slipped further below zero. There is still nothing in the data to dent speculation about the Swiss National Bank easing policy again in December.

In Japan, surprisingly weak household spending was not enough to prevent the RPI creeping up to 10. With the RPI-P now at minus 1, economic activity in general is performing much as forecast and investors remain uncertain about when the central bank will tighten again. Ahead of Thursday’s third quarter GDP update, the yen will be a major focal point this week.

In China, signs of unexpectedly strong activity in October, in part due to surging exports, boosted both the RPI and RPI-P to 86, the latter’s strongest print so far in 2024. Recent stimulus packages seem to have helped confidence, but international trade relations could be more of a threat to growth following the U.S. presidential election.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, Olajide Oyadeyi, and Theresa Sheehan

On Tuesday, the German consumer price index is expected to rise 0.4 percent on the month and up 2.0 percent on the year while the UK labour market report ILO unemployment rate is estimated to increase 4.1 percent from 4.0 percent in September.

On Wednesday, the US consumer price index is expected to rise 0.2 percent on the on the month and 0.3 percent increase for the core. Year on year, forecast estimate a 2.6 percent increase for total CPI, up from 2.4 percent in September.

Also on Wednesday, producer inflation in Japan is expected to climb further to 3.0% in October on higher costs for some energy and commodities markets amid heightened tensions between Israel and Iran.

Thursday, Japan's gross domestic product for the July-September quarter is forecast to post a sharp slowdown, up just 0.2% on quarter, or an annualized 0.6%, as consumers remained frugal amid high costs for necessities that were aggravated by a rare, acute rice supply shortage and business investment is believed to have declined. The expected sluggish growth follows a strong 0.7% rebound (annualized 2.9%) in the April-June quarter, which was led by private consumption, which accounts for about 55% of the GDP, and solid corporate capital investment. Domestic demand is expected to add a slight 0.1 percentage point to total domestic output in Q3 after boosting the Q2 GDP by 0.8 point while external demand (exports minus imports) is also seen lackluster, adding just 0.1 point for the first rise in three quarters after trimming Q2 GDP by 0.1 point. From a year earlier, the economy is forecast to have posted its first increase in three quarters, up 0.3%, after falling 1.0% previously.

For the UK, Thursday’s GDP report is expected to show a rise of 0.2 percent for the third quarter and up 0.1 percent on the year.

Friday will bring US retail sales data for October, where ongoing recovery efforts after Hurricanes Helene and Milton are likely to give some boost to overall spending at the start of the third quarter. Consumers will need to replace household goods of all types destroyed in the winds and water dumped by the storms. The first solid hint of this is sales of motor vehicles which rose to 16.0 million units at a seasonally adjusted annual rate for October after a gain to 15.8 million units in September which in turn was above 15.328 million in August. Gasoline prices have been on the decline in October, so that probably won’t make much of a contribution to sales. However, consumers will be buying building materials for repairs and replacing appliances and electronics. Closets and pantries will need to be replenished. Also in October, Amazon held a Prime Day sales event on October 8-9 which could add to sales at nonstore retailers which includes online shopping.

India Industrial Production for September (Mon 0535 IST; Mon 0005 GMT; Sun 1905 EST)

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 2.0% to 2.7%

After a shocking 0.1 percent year-on-year decline in August, estimates look for output to rebound by 2.6 percent in September on the year. August was depressed by weak mining and lower electricity generation.

Germany CPI for October (Tue 0800 CET; Tue 0700 GMT; Tue 0200 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 0.4%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 2.0% to 2.0%

Consensus Forecast, HICP - M/M: 0.4%

Consensus Range, HICP - M/M: % 0.4% to 0.4%

Consensus Forecast, HICP - Y/Y: 2.4%

Consensus Range, HICP - Y/Y: 2.4% to 2.4%

Forecasters uniformly expect no revision to German CPI in the final reading. That would leave CPI up 0.4 percent on the month and up 2.0 percent from a year ago. For HICP, the expected unrevised figures are up 0.4 percent on the month and up 2.4 percent on year.

UK Labour Market Report for October (Tue 0700 GMT; Tue 0200 EST)

Consensus Forecast, ILO Unemployment Rate: 4.1%

Consensus Range, ILO Unemployment Rate: 4.1% to 4.1%

Consensus Forecast, Average Earnings – Y/Y: 3.9%

Consensus Range, Average Earnings – Y/Y: 3.9% to 4.0%

The ILO unemployment rate is expected to edge up to 4.1 percent from 4.0 percent a month earlier. Earnings are seen rising 3.9 percent on the year versus 3.8 percent in the prior month.

Germany ZEW Survey for November (Tue 1100 CEST; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast, Current Conditions: -86.0

Consensus Range, Current Conditions: -86.3 to -86.0

Consensus Forecast, Economic Sentiment: 13.2

Consensus Range, Economic Sentiment: 5 to 18

For current conditions, estimates call for a modest improvement in investor sentiment to minus 86.0 in November from minus 86.9 in October. The sunnier expectations index is seen holding its recent gains at 13.2 in November after an unexpected leap to 13.1 in October from 3.6 in September.

India CPI for October (Tue 1730 IST; Tue 1200 GMT; Tue 0700 EST)

Consensus Forecast, Y/Y: 5.8%

Consensus Range, Y/Y: 5.6% to 5.9%

The consensus looks for CPI to continue accelerating to 5.8 percent on year in October after surging to 5.5 percent in September from August’s 3.7 percent. The September jump in headline inflation was driven by food and fuel prices. Not looking good for RBA rate cuts this year.

US NFIB Small Business Optimism Index for October (Tue 0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 91.7

Consensus Range, Index: 91.5 to 95.0

Small business sentiment is expected to edge up marginally to 91.7 in October from 91.5 in September, presumably with uncertainty ahead of the election keeping a lid on things. November is likely to see a big bounce, given the favorable reception the Trump victory is getting in business and financial circles.

Australia Wage Price Index for Q3 (Wed 1130 AET; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.8% to 1.0%

Consensus Forecast, Y/Y: 3.7%

Consensus Range, Y/Y: 3.6% to 3.8%

Forecasters expect a 0.9 percent quarterly rise and a 3.7 percent increase on year in the third quarter, suggesting moderating wage pressures. WPI was up 0.8 percent and 4.1 percent in the prior quarter. It peaked at a 4.2 percent annual rate in the fourth quarter of 2023.

Eurozone Industrial Production for October (Wed 1100 CET; Wed 1000 GMT; Wed 0500 EST)

Consensus Forecast, M/M: -1.3%

Consensus Range, M/M: -1.5% to -1.0%

Consensus Forecast, Y/Y: -1.4%

Consensus Range, Y/Y: -1.7% to -1.0%

Industrial production is seen falling back by 1.3 percent on the month and down 1.4 percent on the year in October. In September, output surged by 1.8 percent on the month and rose by a modest 0.1 percent on the year.

US CPI for October (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, CPI - M/M: 0.2%

Consensus Range, CPI - M/M: 0.2% to 0.3%

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.5% to 2.6%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.3%

Consensus Range, Ex-Food & Energy - Y/Y: 3.2% to 3.3%

More of the same is the call with a familiar 0.2 percent increase for total CPI on the month and a 0.3 percent rise for the core. Year on year, forecasts center on 2.6 percent for total CPI, up from 2.4 percent in September, and the consensus looks for a 3.3 percent increase for the core. Reports like this have been making investors restless about lack of progress toward the 2 percent target.

Australia Labour Force Survey for October (Wed1130 AET; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4% to 4.2%

Consensus Forecast, Employment – M/M: 25,000

Consensus Range, Employment – M/M: 10,000 to 40,000

Forecasters see the unemployment rate ticking up to 4.2 percent from 4.1 percent last time and a modest 25,000 rise in employment.

UK GDP for Third Quarter (Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.3%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 0.8% to 1.1%

GDP is seen up 0.2 percent on the quarter and up 1.0 percent on year.

UK Industrial Production for September (Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, Industrial Production - Y/Y: -1.2%

Consensus Range, Industrial Production - Y/Y: -1.2% to -1%

Industrial production is seen dropping 1.2 percent on year.

Eurozone GDP Flash for Q3 (Thu 1100 CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.4% to 0.4%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.9% to 0.9%

GDP is seen up 0.4 percent on quarter and up 0.9 percent on year.

US Jobless Claims (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 225,000

Consensus Range, Initial Claims - Level: 222,000 to 227,000

Claims are expected to edge up to 225,000 from 221,000 last week, suggesting no big change in labor market conditions and not far off last week’s four-week moving average of 227,250.

US PPI-Final Demand for October (Thu 0830 EST; Fri 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.2%

Consensus Range, PPI-FD - M/M: 0.2% to 0.4%

Consensus Forecast, PPI-FD - Y/Y: 2.3%

Consensus Range, PPI-FD - Y/Y: 2.2% to 2.3%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

Expectations for PPI call for a 0.2 percent rise on the month and a 2.3 percent increase on year. For PPI excluding food and energy, the consensus looks for a 0.3 percent increase on the month.

China Fixed Asset Investment for October (Fri 1000 CST; Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.5% to 3.5%

Forecasters see fixed asset investment up 3.5 percent in the year to date from a year ago, not much better than the 3.4 percent figure in September, as investors remain reluctant.

China Industrial Production for October (Fri 1000 CST; Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 5.5%

Consensus Range, Y/Y: 5.4% to 5.8%

Industrial production is expected up 5.5 percent on year in October versus September’s 5.4 percent.

China Retail Sales for October (Fri 1000 CST; Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 3.8%

Consensus Range, Y/Y: 3.4% to 4.1%

Growth in consumer spending remains depressed by Chinese standards, amid the prolonged real estate slump. Retail sales are expected up 3.8 percent on year in October after rising 3.2 percent in September.

France CPI for October (Fri 0845 CET; Fri 0745 GMT; Fri 0245 EST)

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 1.2%

Forecasters see CPI unrevised at 1.2 percent on year in the final October report.

Italy CPI for October (Fri 1000 CET; Fri 0900 GMT; Fri 0400 EST)

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.9% to 0.9%

Forecasters see CPI unrevised at 0.9 percent on year in the final October report.

US Retail Sales for October (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Retail Sales - M/M: 0.3%

Consensus Range, Retail Sales - M/M: 0.3% to 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: 0.0% to 0.4%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.4%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.3% to 0.5%

Auto sales were strong in October while gas sales were soft, with prices down. Forecasts look for a modest 0.3 percent rise in retail sales on the month with sales ex-autos also up 0.3 percent and sales ex-autos and gas up 0.4 percent.

Canada Manufacturing Sales for September (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, M/M: -0.8%

Consensus Range, M/M: -0.7% to -0.8%

Forecasters are sticking with the Stats Can estimate of down 0.8 percent for September, more evidence of contraction in Canada after a nasty 1.3 percent drop on the month in August.

US Empire State Manufacturing Index for November (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Index: 0.0