|

The Week Ahead: Highlights

Europe Preview

Europe Gets its First Quarter Report Card Next Week

By Marco Babic, Econoday Economist

In a data-intensive week for Europe, its biggest economies

are reporting their first quarter GDP results. Germany, Italy, and the Eurozone

present their results for the first three months of the year on Wednesday. To

be sure, the activity took place before US tariffs were fully announced; still,

the numbers will provide the basis against which subsequent data for April and

May are compared.

That didn't stop the German government from downgrading its economic forecast

to zero growth from a modest 0.3 percent in January, anticipating tariff

impacts. That is a further blow to Europe's largest economy which hasn't grown

in two years.

It will be a challenge to Germany's new government which takes the reins May 6,

with Chancellor-in-waiting Friedrich Merz seeking to boost growth by loosening

the shackles on government spending. While any increased borrowing would take

time to filter through to the economy, it could have a positive effect on

business sentiment.

Sluggish GDP performance could lead to increased talk of

stagflation. Next week also sees April consumer prices for France, Italy,

Germany, and the Eurozone. While French HICP inflation remained was a modest

0.9 percent in April, it was 2.3 percent in Germany, 2.1 percent in Italy, and

2.2 percent for the Eurozone. That's still close to the ECB's 2 percent target,

but higher trending inflation would put the European Central Bank in a

difficult position.

Will the Consumer Help?

Germany and Italy also report consumer confidence for May and April,

respectively, next week. In April, German consumers were cautious and

confidence, with the willingness to save rising to its highest level in a year.

Italian consumer confidence fell, which corresponds the broader theme of a

cautious consumer.

This is also borne out by recent earnings calls in the US

where companies reliant on consumer spending lowered guidance and forecasts.

Earnings reports can be a good early indicator of emerging trends that could

take more time to show up in the data.

Final manufacturing PMIs are released Friday for France,

Germany, and the Eurozone. All are currently below the expansion threshold of

50, and it's unlikely the final data will push them above that.

The data so far have painted a cautious picture in recent weeks, but next

week's data might show more somber tones.

US Preview

GDP, Employment Reports Ahead

By Teresa Sheehan, Econoday Economist

There are two main reports of interest in the April 28 week

- the advance estimate of first quarter GDP and the April data on payrolls and

the unemployment rate.

Forecasts for the advance estimate of growth in the first

quarter at 8:30 ET on Wednesday face an unusually challenging situation. The

advance estimate for the first quarter is often the weakest of the year, so a

soft number should not have too much read into it. However, the advance

estimate is made with several major components including assumption for a month

or two of data.

The impacts of chaotic trade and tariff policy coming out of

the White House could mean that the assumptions are difficult to make this

year.

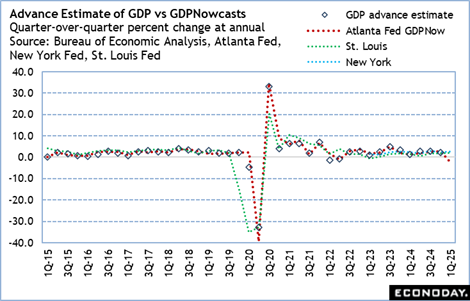

In particular, the GDP Nowcasts do not agree. The latest

forecasts of April 18 are up 2.87 percent and up 2.58 percent from the St.

Louis and New York Feds, respectively. However, the comparable Atlanta Fed's

GDPNow as of April 17 expects growth to decline 2.2 percent and the April 24

update is for growth to decline 2.5 percent. Because of the unusual trade

flower for nonmonetary gold in January and February, the Atlanta Fed offers an

alternative GDPNow excluding gold. As of April 17 it looks for a decline of 0.1

percent and the April 24 reading is down 0.4 percent. Historically, the Atlanta

has the best track record of predicting the advance estimate based on the

forecast about three weeks in advance of the GDP release after the pivotal

monthly employment data has become available. At the moment, market forecasts

have a wide range, but the bottom line is that growth is expected to slow below

the up 2.4 percent of the fourth quarter and what there is will be associated

with front-loaded spending in anticipation of higher prices from tariffs and

supply chain disruptions.

Note that the report on personal income and spending is set

for release at 10:00 ET on Wednesday. Normally it is released the following day

from the GDP number.

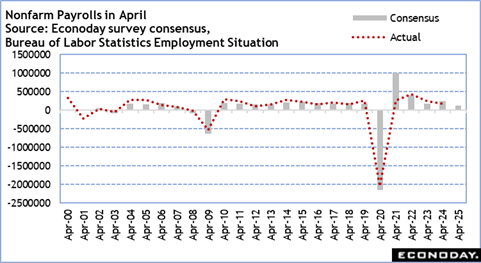

The monthly employment situation for April at 8:30 ET on

Friday has its share of challenges in forecasting. There are two big questions

going into the report. First, if businesses cut back on hiring, and if so, by

how much? The ADP national employment report for April at 8:15 ET on Wednesday

may provide some answers. Second, when are all those massive government layoffs

going to start showing in the private sector? Generous severance benefits and

early retirement may mean many of the federal layoffs are not going to affect

the unemployment rate for months yet. However, the knock-on effects of those

layoffs could be reaching into the private sector soon. The Challenger report

on layoff intentions for April at 7:30 ET on Thursday could provide some clues.

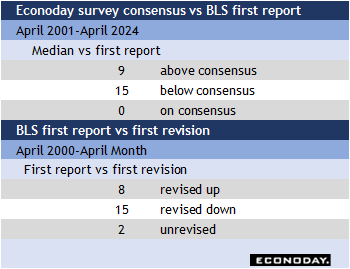

Historically, April payrolls counts tend to come in below

the market consensus forecast. There is also a tendency to be revised lower in

the following month. In any case, the April report will set the tone for the

labor market in the second quarter 2025.

Asia Preview

Purchasing Managers Reports to Register Tariff Effects

By Brian Jackson, Econoday Economist

PMI survey data for April will be the main focus of the

Asia-Pacific calendar next week. After President Trump announced higher tariffs

at the start of the month, the PMI surveys will provide the first broad

indication of how the escalation of global trade tensions and associated market

volatility is impacting activity and sentiment in the region. Chinese PMI data

will be watched particularly closely.

Australia will also publish several key indicators next week ahead of the next

RBA policy meeting mid-May, with monthly and quarterly inflation data likely to

have a big impact on the policy outlook. At their previous meeting early-April,

officials noted that they are not yet sure that inflation will return to the

midpoint of its target range of two percent to three percent "on a sustainable

basis" but stressed that this remains their primary objective. Retail trade and

merchandise trade data for March will also be published.

South Korea will publish industrial production and retail sales for March and

inflation and external trade data for April. The April data may show some

impact of the escalation in trade tensions and market volatility and will help

Bank of Korea officials assess economic conditions for their next policy

meeting at the end of May.

The Week Ahead: Econoday Consensus Forecasts

Tuesday

Germany GfK Consumer Climate for May (Tue 0800 CEST; Tue

0600 GMT; Tue 0200 EDT)

Consensus Forecast, Index: -25.5

Consensus Range, Index: -28.0 to -25.0

The consensus sees the index at minus 25.5 in May versus

minus 24.5 in April as consumers remain gloomy.

Eurozone M3 Money Supply for March (Tue 1000 CEST; Tue

0800 GMT; Tue 0400 EDT)

Consensus Forecast, Y/Y - 3-Month Moving Average: 4.1%

Consensus Range, Y/Y - 3-Month Moving Average: 4.0% to

4.2%

Forecasters see money supply growth at 4.1 percent in March

versus 3.8 percent in February.

Italy Business and Consumer Confidence for April (Tue

1000 CEST; Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Consumer Confidence: 94.1

Consensus Range, Consumer Confidence: 94.0 to

94.2

Confidence expected down to 94.1 from 95.0 last month.

Eurozone EC Economic Sentiment for April (Tue 1100 CET;

Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, Economic Sentiment: 94.5

Consensus Range, Economic Sentiment: 94.0 to 95.0

Consensus Forecast, Industry Sentiment: -11.1

Consensus Range, Industry Sentiment: -12.0 to -10.6

Consensus Forecast, Consumer Sentiment: -16.7

Consensus Range, Consumer Sentiment: -16.7 to -14.1

Economic sentiment expected at 94.5 for April versus 95.2 in

the previous report.

United States International Trade in Goods (Advance) for

March (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Balance: -$142.0 B

Consensus Range, Balance: -$149.8 B to -$124.3 B

Goods trade gap is expected slightly narrower at $142.0

billion in February from $147.0 billion in January.

United States Wholesale Inventories (Advance) for March (Tue

0830 EDT; Tue 1230 GMT)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: 0.5% to 0.6%

Forecasters see wholesale inventories up 0.6 percent on the

month in the flash March report.

United States FHFA House Price Index for February (Tue

0900 EDT; Tue 1300 GMT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.3% to 0.4%

Housing prices expected up a moderate 0.3 percent on the

month.

United States Consumer Confidence for April (Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, Index: 87.5

Consensus Range, Index: 85.7 to 90.0

If the University of Michigan survey of consumers is

anything to go on, with a decline of 8 percent on the month, this will be a

bleak report as consumers are fearful about the outlook. The consensus looks

for a drop to 87.5 in April from 92.9 in March and 100.1 in February.

United States JOLTS for March (Tue 1000 EDT; Tue 1400

GMT)

Consensus Forecast, Job Openings: 7.464 M

Consensus Range, Job Openings: 7.30 M to 7.60 M

Job openings are seen down at 7.464 million in March after

declining to 7.568 million in February from 7.762 million in January as

employers are pulling back amid rising business uncertainty.

Wednesday

Japan Industrial Production March (Wed 0850 JST; Tue 2350

GMT; Tue 1950 EDT)

Consensus Forecast, M/M: -0.9%

Consensus Range, M/M: -1.3% to 0.2%

Consensus Forecast, Y/Y: 0.0%

Consensus Range, Y/Y: -0.5% to 2.1%

Japan's industrial production is forecast to post its first

drop in two months in March, down 0.9%, hit by softer export demand and in

playback for a sharp 2.3% rebound in February, which was the first increase in

four months. The Bank of Japan's real export index showed a 3.2% slip on the

month in March amid a pullback in the auto industry and technology sector

(smartphones, computer chips and steppers for producing integrated circuits

among others), although the index registered a solid 3.2% rise on quarter in Q1

(vs. 0.3% dip in Q4), thanks to a 7.4% jump in February.

Looking ahead, the actual drag from the global trade war

launched by President Trump is unlikely to show much in April yet but

on-and-off tariff rhetoric and imposition is keeping manufacturers cautious

about drawing up production plans and earnings outlook. The monthly survey by

the Ministry of Economy, Trade and Industry released last month indicated that

output would edge up 0.6% in March (a rare case of the same figure after

adjustment for the production index's upward bias), led by a continued rise in the

output of production machinery, before turning nearly flat (+0.1%) in April.

From a year earlier, factory output is expected to be

unchanged in March (forecasts ranged widely from -0.5% to +2.1%) after rising

just 0.1% (revised down from +0.3%) in February and rebounding a partial 2.2%

in January on the 6.7% plunge in January 2024 that was triggered by suspension

of all domestic production by Toyota Motor group firm Daihatsu over a vehicle

safety scandal from late December until mid-February, which had a widespread

impact beyond the auto industry.

Japan Retail Sales for March (Wed 0850 JST; Tue 2350 GMT;

Tue 1950 EDT)

Consensus Forecast, M/M: -1.0%

Consensus Range, M/M: -1.3% to -0.9%

Consensus Forecast, Y/Y: 3.0%

Consensus Range, Y/Y: -0.5% to 4.2%

Japanese retail sales are forecast to have picked up to a

solid 3.0% rise on the year in March after they slowed sharply from a 4.4% jump

in January to a 1.4% hop in February, when snow storms hampered physical

shopping and the year-on-year performance paled in comparison to the 8.3%

leap-year surge in February 2024. The nature and other factors were not so kind

to the retail sector in March, either. Erratic weather patterns dampened demand

for spring clothing and the firmer yen and stricter duty-free shopping rules

dented spending by visitors from overseas at department store chains. Overall

sales were propped up by stable but elevated gasoline prices in the face of

reduced government subsidies.

On the month, retail sales are expected to post their first

decline in three months, down 1.0%, following a 0.4% gain in February, a sharp

1.2% rebound in January and a 0.2% dip in December.

Australia Monthly CPI for March (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.2% to 2.3%

CPI is expected to show a 2.3 percent rise on year versus

2.4 percent in February.

Australia CPI for First Quarter (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.7% to 0.9%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.2% to 2.3%

CPI seen up 0.8 percent on quarter and 2.3 percent on year.

China CFLP Composite PMI for April (Wed 0930 CST; Wed

0130 GMT; Wed 2130 EDT)

Consensus Forecast, Manufacturing Index: 49.7

Consensus Range, Manufacturing Index: 48.5 to 49.8

Consensus Forecast, Non-Manufacturing Index: 50.5

Consensus Range, Non-Manufacturing Index: 50.0 to 50.7

The manufacturing PMI is seen marginally in contraction at 49.7

versus 50.5 in March and services at 50.5 versus 50.8.

China PMI Manufacturing for April (Wed 0945 CST; Wed 0145

GMT; Wed 2145 EDT)

Consensus Forecast, Index: 49.9

Consensus Range, Index: 49.1 to 50.0

Index seen eroding to 49.9 from 51.2 in March.

Germany Retail Sales for March (Wed 0800 CEST; Wed 0600

GMT; Wed 0200 EDT)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: -0.6% to 0.3%

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 2.0% to 3.2%

The consensus sees sales down 0.4 percent on the month -- after

a 0.8 percent increase in the prior month -- and up 2.4 percent on year.

Germany Unemployment Rate for April (Wed 0955 CEST;

Wed 0755 GMT; Wed 0355 EDT)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.4%

Forecasters see the jobless rate at 6.3 percent, unchanged

from March.

Germany GDP Flash for First Quarter (Wed 1000 CEST;

Wed 0800 GMT; Wed 0400 EDT)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.2%

Consensus Forecast, Y/Y: -0.2%

Consensus Range, Y/Y: -0.2% to -0.1%

After contracting 0.2 percent in Q4 on quarter, the forecast

for the Q1 flash looks for an increase of 0.2 percent on the quarter.

Eurozone GDP for First Quarter (Wed 1000 CEST; Wed 0800

GMT; Wed 0400 EDT)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.2%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 0.9% to 1.1%

The consensus sees GDP up 0.2 percent on the quarter and 1.0

percent on year.

Germany CPI for April (Wed 1400 CEST; Wed 1200 GMT; Wed

0800 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.2% to 0.4%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 1.9% to 2.1%

CPI expected up 0.4 percent on the month in April versus an

increase of 0.3 percent in March. On year, expectations call for an increase of

2.0 percent versus 2.2 percent in March.

United States ADP Employment Report for April (Wed 0815

EDT; Thu 1215 GMT)

Consensus Forecast, Private Payrolls - M/M: 125K

Consensus Range, Private Payrolls - M/M: 80K to 150K

Private payrolls are expected up a relatively modest 125K in

April after a moderate rise of 155k in March.

Canada Monthly GDP for February (Wed 0830 EDT; Thu 1230

GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.1% to 0.0%

Canada saw 0.4 percent growth in January as things looked

good pre-trade war. The call for February looks for no growth.

United States GDP for First Quarter (Wed 0830 EDT; Wed1230

GMT)

Consensus Forecast, Q/Q - Annual Rate: 0.2%

Consensus Range, Q/Q - Annual Rate: -1.5% to 1.1%

Growth stalled in Q1 amid uncertainties over tariffs, DOGE,

other headwinds, with a rush of imports to beat expected price increases

cutting into GDP. The consensus looks for almost no growth at 0.2 percent, down

from 2.4 percent in Q4. Many forecasters see contraction coming.

United States Employment Cost Index for First Quarter (Wed

0830 EST; Wed 1230 GMT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.8% to 1.0%

Employment costs are seen rising at the same 0.9 percent

rate in Q1 after rising 0.9 percent in Q4 on quarter.

United States Chicago PMI for April (Wed 0945 EDT; Wed

1345 GMT)

Consensus Forecast, Index: 45.8

Consensus Range, Index: 45.4 to 46.5

This index remains way in negative territory, expected down at

45.8 in April after 47.6 in March.

United States Personal Income and Outlays for March (Wed

1000 EDT; Wed 1400 GMT)

Consensus Forecast, Personal Income - M/M: 0.4%

Consensus Range, Personal Income - M/M: 0.0% to 0.6%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.5%

Consensus Range, Personal Consumption Expenditures - M/M:

0.3% to 1.0%

Consensus Forecast, PCE Price Index - M/M: 0.0%

Consensus Range, PCE Price Index - M/M: 0.0% to 0.0%

Consensus Forecast, PCE Price Index - Y/Y: 2.2%

Consensus Range, PCE Price Index - Y/Y: 2.2% to 2.3%

Consensus Forecast, Core PCE Price Index - M/M: 0.1%

Consensus Range, Core PCE Price Index - M/M: 0.1% to 0.1%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.6%

Consensus Range, Core PCE Price Index - Y/Y: 2.5% to

3.0%

Personal income seen up 0.4 percent, with personal spending

up 0.5 percent on the month. PCE prices seen flat on the month and up only 0.1

percent for the core.

Thursday

Australia International Trade in Goods for March (Thu

1130 AET; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Balance: A$3.1B

Consensus Range, Balance: A$2.4 B to A$4.9 B

The trade surplus is seen at A$3.1 billion in March versus

A$2.968 billion in February.

Japan Bank of Japan Announcement (Thu 1130 JST; Thu 0230

GMT; Wed 2230 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 0.5%

Consensus Range, Level: 0.5% to 0.5%

The Bank of Japan's nine-member board is expected to remain

cautious amid high uncertainty over a global trade war that has already hurt

sentiment among large manufacturers, after having decided unanimously to

maintain the target for overnight interest rate at 0.5% in March. Previously,

the panel voted 8 to 1 to raise the policy rate by another 25 basis points to

0.5% in January in a third rate hike during the current normalization process

that began in March 2024. Members are closely monitoring whether high wage

increases by major firms will spread to smaller firms in fiscal 2025 that began

on April 1 at a time when real wages are falling, which could hurt consumption

further and generate deflationary pressures.

The bank stays on course toward normalizing its monetary

policy stance further after a decade of large-scale cash injections aimed at

turning around stubborn deflation that had been in place until Governor Kazuo

Ueda took office about two years ago. "If the outlook for the underlying

inflation rate settling toward 2% is realized, we will raise interest rates and

adjust the degree of monetary easing accordingly," the governor told reporters

last week after a meeting of the G20 financial policymakers. But Ueda also said

he will "monitor data carefully without any presumptions" to ensure that the

underlying measure of inflation "converges" around the bank's 2% target amid

high uncertainty over a global trade war initiated by President Trump.

United States Jobless Claims for Week 4/26 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 225K

Consensus Range, Initial Claims - Level: 220K to 228K

Claims have been seesawing around the 4-week moving average near

220K and are seen at 225K in the latest week versus 222K last week.

United States PMI Manufacturing Final for April (Thu 0945

EDT; Thu 1345 GMT)

Consensus Forecast, Index: 50.7

Consensus Range, Index: 50.7 to 50.7

No change from the flash at 50.7 is expected as

manufacturing business stays flat.

United States ISM Manufacturing Index for April (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, Index: 48.0

Consensus Range, Index: 47.0 to 49.3

A softer sub-50 reading is seen at 48.0 in April after 49.0

in March showed the ill effects of the trade war.

United States Construction Spending for March (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 0.3%

The consensus looks for an increase of 0.3 percent after a

0.7 percent increase in February.

Friday

Japan Unemployment Rate for March (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, M/M: 2.4%

Consensus Range, M/M: 2.4% to 2.5%

Japanese payrolls are expected to post their 32nd straight

rise on year in March amid lingering labor shortages and despite growing

uncertainty over a global trade war launched by President Trump. The seasonally

adjusted unemployment rate is forecast to be unchanged at 2.4% after easing

slightly to the level in February and having been stable at 2.5% in the

previous four months. It stood at 2.4% in September 2024, which was the lowest

in more than four years (since 2.4% in February 2020).

The government continues to describe employment conditions

as "showing signs of improvement" in its latest monthly economic report.

Major firms have matched or exceeded union demands for base wage hikes for the

fiscal year that starts on April 1 but elevated costs of living have pushed the

real wage y/y change into a drop, squeezing many households.

Australia Retail Sales for March (Fri 1130 AET; Fri 0130

GMT; Thu 2130 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.2% to 0.9%

Sales are expected up 0.5 percent on the month in March

after rising 0.2 percent in February.

United States Motor Vehicle Sales for April (ANYTIME)

Consensus Forecast, Total Vehicle Sales - Annual Rate: 16.8

M

Consensus Range, Total Vehicle Sales - Annual Rate: 15.3

M to 18.2 M

Sales got a lift from consumers frontrunning tariffs at a

17.8 million unit annual rate in March. For April, forecasters see a16.8

million rate.

Germany PMI Manufacturing Final for April (Fri 0955 CEST;

Fri 0755 GMT; Fri 0355 EDT)

Consensus Forecast, Index: 48.0

Consensus Range, Index: 48.0 to 48.0

The consensus sees no revision from the flash at 48.0.

Eurozone PMI Manufacturing Final for April (Fri 1000 CEST;

Fri 0800 GMT; Fri 0400 EDT)

Consensus Forecast, Index: 48.7

Consensus Range, Index: 48.7 to 48.7

The consensus sees no revision from the flash at 48.7.

Eurozone HICP Flash for April (Fri 1100 CEST; Fri 0900

GMT; Fri 0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.1%

Consensus Range, HICP - Y/Y: 1.9% to 2.2%

Consensus Forecast, Narrow Core - Y/Y: 2.5%

Consensus Range, Narrow Core - Y/Y: 2.2% to 2.5%

Forecasters see the HICP at 2.1 percent and 2.5 percent for

narrow core in the April flash versus 2.2 percent and 2.4 percent in March.

Eurozone Unemployment Rate for March (Fri 1100 CEST; Fri

0900 GMT; Fri 0500 EDT)

Consensus Forecast, Rate: 6.1%

Consensus Range, Rate: 6.1% to 6.2%

The jobless rate is expected to hold steady at 6.1 percent

in March from 6.1 percent in February.

United States Employment Situation for April (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 130K

Consensus Range, Nonfarm Payrolls - M/M: 25K to 150K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.1% to 4.3%

Consensus Forecast, Private Payrolls - M/M: 125K

Consensus Range, Private Payrolls - M/M: 95K to 150K

Consensus Forecast, Manufacturing Payrolls - M/M: -3K

Consensus Range, Manufacturing Payrolls - M/M: -10K to

5K

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.3%

to 0.3%

Consensus Forecast, Average Hourly Earnings - Y/Y: 3.9%

Consensus Range, Average Hourly Earnings - Y/Y: 3.9%

to 3.9%

Consensus Forecast, Average Workweek: 34.2 hrs

Consensus Range, Average Workweek: 34.2 hrs to 34.2 hrs

Payroll growth is slowing with employers wary of adding

costs. The consensus sees jobs up 130K versus 228K in March with the jobless

rate flat at 4.2 percent.

United States Factory Orders for March (Fri 1000 EDT;

Fri 1400 GMT)

Consensus Forecast, M/M: 3.7%

Consensus Range, M/M: 0.5% to 4.8%

With durable goods orders up strongly, factory orders

expected to show a big gain at 3.7 percent.

|