|

The Week Ahead: Highlights

Europe Preview

Sentiment Readings to Show Tariff Effects

By Marco Babic, Econoday Economist

Sentiment indicators for May are front and center for the

week ahead in Europe and will provide assessments of the current state of the

economy and also what is expected. April was the month following the imposition

of US tariffs which provided a full month of data. While there were signs of

caution and some cracks emerging, there is no doubt that uncertainty is the

watchword.

This was evident in consumer confidence in the Eurozone

which dropped to an 18-month low in May. There is little reason to believe they

are more optimistic in May than they were in April, particularly as prices for

staples are on the rise. Tuesday's preliminary report will let us know if

sentiment has soured further.

Thursday brings a rich palette of data with flash PMI

readings for France, Germany, and the Eurozone. Last month, all three composite

elements contracted and although the Eurozone remained just above the 50 mark,

indicating expansion, albeit barely with a reading of 50.1. France and Germany

were at 47.3 (previously 48.0), and 49.7 (previously 51.3).

Adding some additional color to the PMI reports are the

French Business Climate indicator which rose to 99 in April from 96, and

Germany's Ifo expectations index which fell back only modestly to 87.4 from

87.7. So far, the dam has not yet burst on sentiment indicators, but these will

certainly be closely watched next week for any sign of cracks.

On the policy side, the European Central Bank releases a

summary of the minutes from its last meeting and will be closely parsed to see

what the ECB is thinking. With inflation showing no signs of spiking at the

moment, the prevailing market view is for further easing of monetary policy.

Flash readings for inflation in the Eurozone put HICP at 2.2

percent in April over a year ago, while a narrower measure rose 2.7 percent.

The final readings will provide more detail, and will give insights into

possible emerging sectoral pressures, in particular fresh food and consumer

staples.

On Friday, Germany reports on its first quarter GDP which

preliminary readings estimating a 0.2 percent gain over the previous quarter

and a 0.2 percent decline from the comparable year-ago quarter.

Consumers and businesses have and an additional month to

made judgements on the direction of respective economies. Much of the official

data is still catching up with actual events, but next week will provide some

direction and context.

US Preview

Housing Sector Not Feeling Well for Spring

By Theresa Sheehan, Econoday Economist

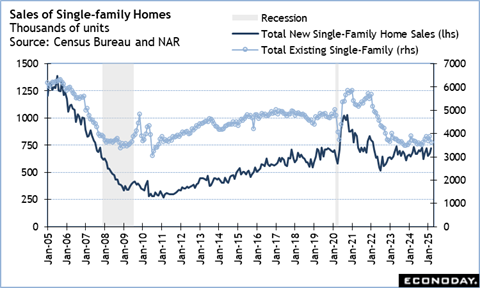

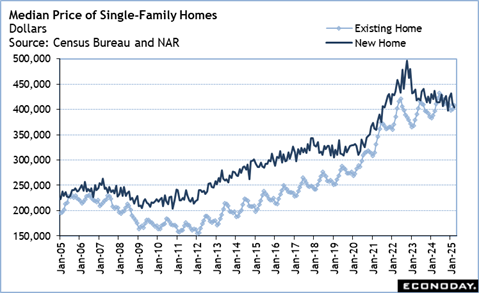

The housing sector is not behaving as it typically does in

the spring months when many consumers start looking to buy a home - either new

or existing construction. In particular, in early 2025 consumers are highly

uncertain about the economic outlook and their job security. Homebuying can be

less affordable with prices at record highs in many markets and mortgage rates

not far below the 7 percent-mark.

April data on home sales is set for release in the May 19

week. The NAR's report on existing home sales is at 10:00 ET on Thursday and

the Census Bureau's report on sales of new single-family homes is at 10:00 ET

on Friday.

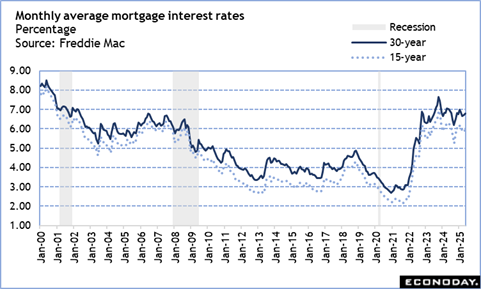

Homebuying probably picked up in April while mortgage rates

were somewhat lower. The Freddie Mac monthly average for a 30-year fixed rate

loan is down from 6.84 percent in February to 6.65 percent in March and then a

bit higher at 6.73 percent in April. Homebuyers who managed to lock in a lower

rate during the March and April period would be anxious to sign a home contract

before the rate lock expired.

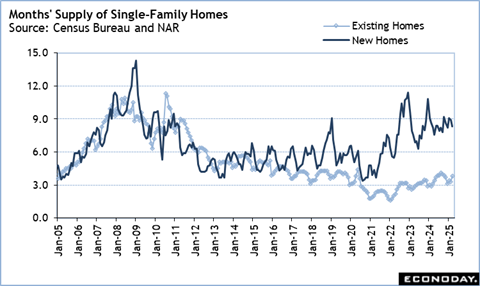

Existing homes are probably at an advantage for securing

sales in April, particularly for the si. Supplies of existing units have

improved and potential buyers have more power to negotiate on price and terms.

This is a negative for new home sales which are often more expensive and with

less space for concessions to secure a sale. Builders are cutting back on new

construction to prevent unwanted inventory accumulation at a time when the

economic outlook is uncertain. Not only is there more supply in existing

inventories but there are fewer buyers in the market.

Asia Preview

China PMI Business Activity in Focus

By Brian Jackson, Econoday Economist

Monthly Chinese activity data for April will be the main

focus of the Asia-Pacific data calendar in the week ahead, with these

indicators covering the initial period after the escalation in trade tensions

and market volatility early in the month. PMI surveys showed a deterioration in

conditions and sentiment in both the manufacturing and services sectors in

China in April, and officials have already responded by easing bank reserve

requirements. The statement accompanying the offical data may provide some information

about the policy outlook ahead of the monthly loan prime rate setting later in

the week.

The other highlight will be the Reserve Bank of Australia

policy meeting, with officials also set to publish updated economic forecasts.

After cutting rates for the first time since 2020 in February, the RBA left

them unchanged at its last meeting at the start of April. Data published since

then have showed ongoing strength in the labour market but a moderation in

underlying measures of inflation may be enough to prompt another rate cut.

Singapore and Hong Kong will report inflation data.Trade

data for April will provide an indication of the initial impact of the

escalation in global trade tensions on New Zealand's trade flows.

The Week Ahead: Econoday Consensus Forecasts

Monday

New Zealand Retail Trade for First Quarter (Mon 1045 NZST;

Sun 2245 GMT; Sun 1845 EDT)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: -0.8% to 0.0%

After an upbeat Q4 boosted by household durables, sales

fizzled in Q1. Real sales are expected flat on the quarter with the risk of a

weaker number.

China Fixed Asset Investment for April (Mon 1000 CST;

Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: 4.2%

Consensus Range, Year to Date on Y/Y Basis: 4.2% to 4.3%

Annual growth expected unchanged at 4.2 percent in April

from 4.2 percent in March.

China Industrial Production for April (Mon 1000 CST; Mon

0200 GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 5.9%

Consensus Range, Y/Y: 5.5% to 6.4%

The consensus sees output growth slowing to 5.9 percent in

April from 7.7 percent in March.

China Retail Sales for April (Mon 1000 CST; Mon 0200

GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 6.0%

Consensus Range, Y/Y: 5.0% to 6.0%

Sales growth seen flattish at 6.0 percent in April versus

5.9 percent in March.

Eurozone HICP for April (Mon 1100 CEST; Mon 0900 GMT;

Mon 0500 EDT)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: 0.6% to 0.6%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 2.2% to 2.2%

Consensus Forecast, HICP Narrow Core - Y/Y: 2.7%

Consensus Range, HICP Narrow Core - Y/Y: 2.7% to 2.7%

Forecasters expect no revision from the flash 2.2 percent on

year and no change at 2.7 percent for narrow core.

United States Leading Indicators for April (Mon 1000 EDT;

Mon 1600 GMT)

Consensus Forecast, M/M: -0.8%

Consensus Range, M/M: -1.0% to 0.1%

The consensus looks for another nasty decline of 0.8 percent

in April after March's 0.7 percent drop with consumer sentiment and stock

prices taking a hit in April.

Tuesday

China Loan Prime Rate for May (Tue 0900 CST; Tue 0100

GMT; Mon 2100 EST)

Consensus Forecast, 1-Year Rate - Change: -10 bp

Consensus Range, 1-Year Rate - Change: -10 bp to -10

bp

Consensus Forecast, 1-Year Rate - Level: 3.0%

Consensus Range, 1-Year Rate - Level: 3.0% to 3.0%

Consensus Forecast, 5-Year Rate - Change: -10 bp

Consensus Range, 5-Year Rate - Change: -10 bp to -10

bp

Consensus Forecast, 5-Year Rate - Level: 3.50%

Consensus Range, 5-Year Rate - Level: 3.50% to 3.50%

Forecasters see 10 bp cuts in the LPR to 3.0 percent for the

one-year and 3.50 percent for the five-year.

Australia RBA Announcement (Tue 1430 AEST; Tue 0430 GMT;

Tue 0030 EDT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 3.85%

Consensus Range, Level: 3.85% to 3.85%

With elections past, forecasters look for a big 50 basis

point cut after the RBA played it safe with no action in April even as the

economy weakened. More rate cuts are expected this year.

Germany PPI for April (Tue 0800 CEST; Tue 0600 GMT; Tue

0200 EDT)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -0.3% to -0.2%

Consensus Forecast, Y/Y: -0.5%

Consensus Range, Y/Y: -0.7% to -0.5%

Deflation continues with wholesale prices expected down 0.3

percent on month in April and down 0.5 percent on year after declines of 0.7

percent and 0.2 percent respectively in March.

Canada CPI for April (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: -0.1%

Consensus Range, CPI - M/M: -0.3% to 0.5%

Consensus Forecast, CPI - Y/Y: 1.7%

Consensus Range, CPI - Y/Y: 1.5% to 2.3%

Forecasters see CPI down 0.1 percent on the month and up 1.7

percent on year in April versus increases of 0.3 percent and 2.3 percent in

March. The end of the consumer carbon tax in April should dampen inflation on

the month.

Eurozone EC Consumer Confidence Flash for May (Tue

1600 CEST; Tue 1400 GMT; Tue 1800 EDT)

Consensus Forecast, Index: -16.0

Consensus Range, Index: -16.7 to -15.5

Forecasters see the index edging up to minus 16.0 in May

from minus 16.7 in April.

Wednesday

Japan Merchandise Trade for April (Wed 0850 JST; Tue 2350

GMT; Tue 1950 EDT)

Consensus Forecast, Balance: ¥191.30 B

Consensus Range, Balance: ¥-140.50 B to ¥343.80 B

Consensus Forecast, Imports - Y/Y: -3.9%

Consensus Range, Imports - Y/Y: -8.0% to 0.1%

Consensus Forecast, Exports - Y/Y: 3.1%

Consensus Range, Exports - Y/Y: -0.6% to 8.5%

Japanese export values are forecast to post a seventh

straight year-on-year rise in April, up 3.1%, after rising 3.9% in March

(economist forecasts ranged widely from a 0.6% drop to a 8.5% gain). The

increase is expected to be led by solid demand for computer chips, ships and

drugs. By contrast, exports of automobiles as well as iron and steel are seen

down, hit by the Trump administration's stiff tariffs on imports from many U.S.

trading partners, but the full impact of the global trade war is likely to be

seen in May data onward.

Import values are expected to slip back 3.9% after

rebounding 2.0% in March on a 0.7% dip the previous month. The decrease was

likely led by lower purchases crude oil, coal and aircraft as seen the previous

month, judging from the Ministry of Finance trade data for the first 20-days of

April. The prices for crude oil and other materials have eased on dimmer global

growth prospects while a firmer yen on waning U.S. currency safe-haven status

has lowered import costs. The yen appreciated to an average ¥144.39 against the

dollar in April during Tokyo trading hours from a recent bottom of ¥156.49 in

January 2025 and from ¥153.43 in April 2024, Bank of Japan data showed.

The trade balance is forecast to post a surplus of ¥191.30

billion, shrinking from a revised ¥559.43 billion surplus in March but widening

from a ¥504.69 billion deficit in April 2024. It would be a third straight

monthly positive figure and a fifth surplus in 12 months. There is a slight

possibility of Japan posting a trade deficit on weak exports in April.

United Kingdom CPI for April (Wed 0700 BST; Wed 0600

GMT; Tue 0200 EDT)

Consensus Forecast, M/M: 1.0%

Consensus Range, M/M: 0.7% to 1.1%

Consensus Forecast, Y/Y: 3.3%

Consensus Range, Y/Y: 3.2% to 3.4%

UK annual inflation seen at 3.3 percent in April versus 2.6

percent in March. Month on month, the consensus looks for an increase of 1.0

percent after 0.3 percent in March, with a bump in energy costs largely to

blame.

Thursday

Japan Machinery Orders for March (Thu 0850 JST; Wed 2350

GMT; Wed 1950 EDT)

Consensus Forecast, M/M: -1.6%

Consensus Range, M/M: -2.5% to 0.5%

Consensus Forecast, Y/Y: -2.0%

Consensus Range, Y/Y: -5.5% to -0.9%

Japanese core machinery orders, the key leading indicator of

business investment in equipment, are forecast to slip back 1.6% in March

(range: -2.5% to +0.5%) after rebounding 4.3% in February on a 3.5% dip in

January. Plans to digitize and automate operations remain solid but labor

shortages, elevated costs and global growth and inflation uncertainties amid a

trade war initiated by the Trump administration are clouding the prospects for

smooth implementation of those plans.

In the January-March quarter, the core measure is forecast

by economists to fall 0.9% on quarter after rebounding 2.3% in October-December

and slipping 0.7% in July-September, which would be firmer than the official

projection of a 2.2% drop. The focus is on the official forecast for the

April-June period when the Trump tariffs are expected to have a larger impact.

From a year earlier, core orders, which track the private

sector and exclude volatile orders from electric utilities and for ships, are

expected to mark their first drop in six months, down 2.0% (range: -5.5% to

-0.9%), following +1.5% the previous month.

Germany PMI Composite Flash for May (Thu 0930 CEST; Thu

0730 GMT; Thu 0330 EDT)

Consensus Forecast, Composite Index: 50.3

Consensus Range, Composite Index: 49.8 to 50.8

Consensus Forecast, Manufacturing Index: 49.0

Consensus Range, Manufacturing Index: 47.5 to 49.1

Consensus Forecast, Services Index: 49.7

Consensus Range, Services Index: 48.5 to 50.0

The consensus looks for the composite at 50.3 in the May

flash versus 50.1 in the April final; manufacturing at 49.0 in the May flash

versus 48.4 in April; services expected at 49.7 versus 49.0.

Germany Ifo Survey for May (Thu 1000 CET; Thu 0800 GMT;

Thu 0400 EDT)

Consensus Forecast, Business Climate: 87.5

Consensus Range, Business Climate: 87.4 to 89.5

Consensus Forecast, Current Conditions: 86.9

Consensus Range, Current Conditions: 86.8 to 87.0

Consensus Forecast, Business Expectations: 88.0

Consensus Range, Business Expectations: 87.6 to 88.5

Business climate is expected slightly better at 87.5 in May

versus 86.9 in April. Current conditions seen at 86.9 versus 86.4. Business

expectations seen at 88.0 versus 87.4 in April.

Eurozone PMI Composite Flash for May (Thu 1000 CEST; Thu

0800 GMT; Thu 0400 EDT)

Consensus Forecast, Composite Index: 50.9

Consensus Range, Composite Index: 50.0 to 51.2

Consensus Forecast, Manufacturing Index: 49.4

Consensus Range, Manufacturing Index: 48.5 to 49.5

Consensus Forecast, Services Index: 50.5

Consensus Range, Services Index: 49.5 to 50.6

The consensus looks for the composite at 50.9 in the May

flash versus 50.4 in the April final. Manufacturing expected at 49.4 in the May

flash versus 49.0 in the April final. Services is expected at 50.5 versus 50.1

in the April final.

United Kingdom PMI Composite Flash for May (Thu 0930

BST; Thu 0830 GMT; Thu 0430 EDT)

Consensus Forecast, Composite Index: 49.5

Consensus Range, Composite Index: 49.0 to 49.6

Consensus Forecast, Manufacturing Index: 46.0

Consensus Range, Manufacturing Index: 45.5 to 46.4

Consensus Forecast, Services Index: 50.0

Consensus Range, Services Index: 49.3 to 50.5

The composite flash for May is expected at 49.5 versus 48.5

in the April final. The consensus looks for manufacturing at 46.0 in the May

flash versus 45.4 in the April final. Services is expected at 50.0 versus 49.0

in the April final.

United States Jobless Claims Week 5/17 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 230K

Consensus Range, Initial Claims - Level: 226K to 235K

Claims are seen pretty steady at 230K from 229K in the

previous week.

United States PMI Composite Flash for May (Thu 0945

EDT; Thu 1345 GMT)

Consensus Forecast, Manufacturing Index: 49.8

Consensus Range, Manufacturing Index: 49.5 to 50.7

Consensus Forecast, Services Index: 50.6

Consensus Range, Services Index: 50.5 to 51.5

The manufacturing index is expected marginally in

contraction at 49.8 in May versus 50.2 in April. Services seen at 50.6 versus

50.8.

United States Existing Home Sales for April (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, Annual Rate: 4.13 M

Consensus Range, Annual Rate: 3.90 M to 4.27 M

Sales are expected at an annual 4.13 million unit rate in

April versus 4.02 in March. The better forecast reflects the uptick in pending

home sales for the month but even so, the housing market remains depressed.

Friday

Japan CPI for April (Fri 0830 JST; Thu 2330 GMT; Thu 1930

EDT)

Consensus Forecast, Y/Y: 3.6%

Consensus Range, Y/Y: 3.3% to 3.8%

Consensus Forecast, Ex-Fresh Food -Y/Y: 3.4%

Consensus Range, Ex-Fresh Food - Y/Y: 3.3% to 3.8%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.0%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.9%

to 3.2%

Consumer inflation in Japan is expected to accelerate in two

of the three key readings in April after the government halved its heating

season utility subsidies in March, the last of the three-month period (bills

are paid from February to April), but the pace of increase was moderated by the

price-cutting effect of free high school education at a national level that

began on April 1, a year after the Tokyo metropolitan government introduced a

similar program. Firms also tend to raise their retail prices at the April 1

start of the fiscal year, more so this year to pay for rising wages. Processed

food costs remain elevated on the lingering effects of rice shortages. The

government's attempt to bring down the prices for the staple through rebounds

of releasing rice reserves has failed to have much impact.

The current price rises are not backed by domestic demand

(wage-heavy services price hikes are still subdued) but largely pushed up by

higher import costs. This means that it is not accompanied by sustained and

substantial wage growth and that underlying inflation is still below the Bank

of Japan's 2% target.

The core reading (excluding fresh food) is forecast to post

a 3.4% rise on year, the fastest in 25 months (since 3.4% in April 2023), after

its annual rate picked up to 3.2% in March from 3.0% in February to match the

rate in January. The underlying inflation measured by the core-core CPI

(excluding fresh food and energy) is estimated at a 14-month high of 3.0% after

having firmed to 2.9% in March from 2.6% previously.

The year-on-year rise in the total CPI is likely to stand at

3.6% after having unexpectedly eased further to 3.6% in March in light of

slower gains in fresh food prices and decelerating to 3.7% in February from a

two-year high of 4.0% at the start of the year.

In April 2024, consumer inflation in central Tokyo's 23

wards decelerated much faster than expected (the core CPI annual rate slowed to

1.6% from 2.4% in March) as completely free high school education took effect

in the Tokyo metropolitan area, pushing down the CPI by 0.51 percentage points.

The national government had been providing subsides to slash high school

tuition fees but the Tokyo prefectural government added its own financial

support, removing the upper limit on household income from eligibility conditions

and effectively making all public and private tuition free for grade 10 to 12

students.

Singapore CPI for April (Fri 1300 SGT; Fri 0500 GMT; Fri

0100 EDT)

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 1.0% to 1.2%

Headline CPI expected at 1.0 percent on year versus 0.9

percent in March.

United Kingdom Retail Sales for April (Fri 0700 BST; Fri

0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: -0.6% to 0.3%

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.0% to 4.4%

The consensus sees retail sales up 0.3 percent on month and

up 3.5 percent on year.

Germany GDP for First Quarter (Fri 0800 CEST; Fri 0600

GMT; Fri 0200 EDT)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.2%

Consensus Forecast, Y/Y: -0.2%

Consensus Range, Y/Y: -0.4% to -0.2%

Growth expected modest at 0.2 percent in Q1 from Q4 and down

0.2 percent from a year ago.

Canada Retail Sales for March (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.1% to 0.8%

Forecasters agree with Statistics Canada's preliminary

estimate calling for sales to rise 0.7 percent for March from February after

February's decline of 0.4 percent.

United States New Home Sales for April (Fri 1000 EDT;

Fri 1400 GMT)

Consensus Forecast, Annual Rate: 700K

Consensus Range, Annual Rate: 690K to 724K

Sales expected down at 700K rate in April from 724K in March,

reflecting poor affordability and consumer caution.

|