|

The Week Ahead: Highlights

US Preview

Fed's Favored Inflation Measure Highlights Week

By Theresa Sheehan, Econoday Economist

The May 26 week includes the Memorial Day observance on

Monday which means all US markets are closed, and most offices. Consumer-facing

businesses like retailers and travel facilities will be open at the unofficial

start of summer. Retailers will be offering sales incentives to get warm

weather merchandise moving off shelves and avoid any unwanted build up in

inventories, especially after stocking up in advance of tariffs.

The minutes of the May 6-7 FOMC meeting are set for release

at 14:00 ET on Wednesday. Three weeks ago, the committee met against the

backdrop of a rapidly changing political environment, and an uncertain outlook

for the economy as the impacts remained unseen in the data. Although

pronouncements about tariffs have slowed and the worst of the tax rates walked

back, the data has yet to catch up with events. The minutes will not have much

to tell except perhaps some clarification in how the FOMC intends to manage

interest rate policy should the dual mandate come into tension from rising

unemployment and still elevated inflation.

The second estimate of first quarter GDP at 8:30 ET on

Thursday could see some minor revisions from the down 0.3 percent in the

advance report. If there is an upward revision in the personal consumption

expenditures component, other aspects like net exports will probably offset

that. In any case, the first quarter's growth was stymied by the steep widening

in the trade deficit that is likely a short-term event. In question is whether

it will come into better balance in the second quarter. As of May 16, the Atlanta

Fed's GDPNow - the most reliable of the early forecasts for growth - points to

an increase of 2.4 percent for the second quarter. If realized, it would once

again show that the US economy is resilient to economic shocks and able to

regain its footing quickly.

For the moment, Fed policymakers will have to make the best

analysis of the economic data they can, and set policy accordingly. The April

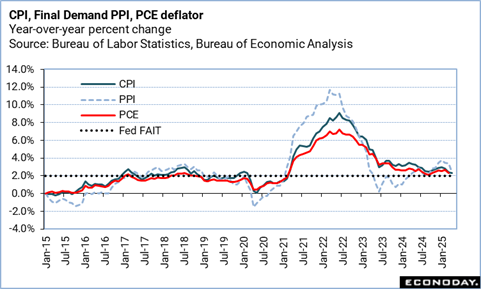

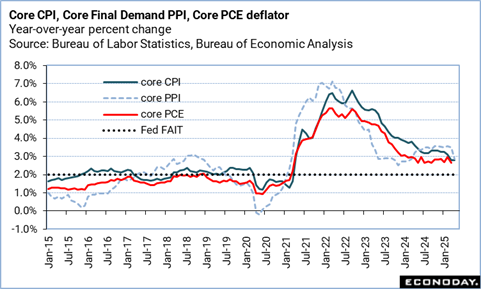

report on personal income and spending at 8:30 ET on Friday includes the Fed's

preferred measure of inflation - the PCE deflator. That report should mirror

the April CPI numbers with a modest month-over-month increase at both the

all-items and core levels, and a flattening in progress in disinflation on a

year-over-year basis.

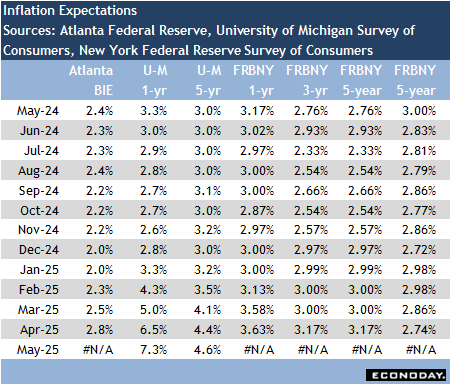

However, even if current inflation readings are deemed

sufficient to consider lowering the current fed funds target rate range of

4.25-4.50 percent, current inflation expectations have continued to rise for

both the short- and medium- terms since the start of the year. While the recent

jump to decades-high levels are probably an artefact of the chaos around

tariffs and trade policy since the advent of the second Trump administration,

these cannot be ignored. The FOMC cannot let inflation expectations become

unanchored. The FOMC may be fully expecting these to moderate in the near

future as policy becomes more settled and certain. But until that happens,

interest rate policy is on hold.

Asia-Pacific Preview

Central Bank Rate Cuts Coming

By Brian Jackson, Econoday Economist

Policy decisions from the Reserve Bank of New Zealand and

the Bank of Korea will be the main focus of the Asia-Pacific data calendar in

the week ahead. Several other indicators are also scheduled for release.

RBNZ officials have now lowered policy rates by a cumulative

200 basis points over their last five meetings. Data released after the

previous meeting in early April showed an increase in headline inflation in the

three months to March but it has now remained within its target range of two

percent to three percent for three consecutive quarter. This will likely give

officials confidence that they have scope to provide further policy support

after they noted concerns about the growth outlook at their last meeting.

The Bank of Korea left its policy rate on hold at its last

meeting mid-April but has cut rates in three of its last five meetings. Both

headline and core inflation have been low and steady in recent months and

incoming data have shown that trade tensions have impacted activity and

sentiment. Officials, however, may be reluctant to change policy settings just

a few days before presidential elections scheduled for early June.

Key Australian data will be published next week, including

the monthly CPI and retail sales data for April and quarterly investment

spending data. India and Taiwan will both publish GDP reports, while India,

South Korea and Singapore will all report industrial production data for

April. These industrial production numbers may provide more information about

the initial impact of the escalation in trade tensions. Finally, China's

official PMI survey and South Korean trade data will be published next weekend,

providing an early indication whether the impact of those trade tensions has

extended into May.

The Week Ahead: Econoday Consensus Forecasts

Monday

Singapore Industrial Production for April (Mon 1300

SGT; Mon 0500 GMT; Mon 0100 EDT)

Consensus Forecast, M/M: 6.3%

Consensus Range, M/M: 6.1% to 6.3%

Consensus Forecast, Y/Y: 2.5%

Consensus Range, Y/Y: 2.4% to 2.6%

The consensus looks for output up 6.3 percent on the month

and up 2.5 percent on the year.

Tuesday

Germany GfK Consumer Climate for June (Tue 0800 CEST; Tue

0600 GMT; Tue 0200 EDT)

Consensus Forecast, Index: -20.0

Consensus Range, Index: -21.0 to -19.0

The consensus sees the index pretty stable at minus 20.0 in

June versus minus 20.6 in May.

Eurozone EC Consumer Sentiment for May (Tue 1100

CEST; Tue 1300 GMT; Tue 0900 EDT)

Consensus Forecast, Economic Sentiment: 94.0

Consensus Range, Economic Sentiment: 93.0 to 94.2

Consensus Forecast, Industry Sentiment: -10.6

Consensus Range, Industry Sentiment: -12.0 to -10.5

Consensus Forecast, Consumer Sentiment: -15.2

Consensus Range, Consumer Sentiment: -15.2 to -15.2

Economic sentiment expected at 94.0 for May versus 93.6 in

the previous report. Industry sentiment seen at minus 10.6 versus minus 11.2.

Consumer sentiment seen at minus 15.2.

United States Durable Goods Orders for April (Tue 0830

EDT; Tue 1230 GMT)

Consensus Forecast, New Orders - M/M: -8.1%

Consensus Range, New Orders - M/M: -10.0% to -0.5%

Consensus Forecast, Ex-Transportation - M/M: -0.1%

Consensus Range, Ex-Transportation - M/M: -1.4% to 0.3%

Consensus Forecast, Core Capital Goods - M/M: 0.0%

Consensus Range, Core Capital Goods - M/M: -0.1% to 0.3%

Durable goods orders expected to show a big drop of 8.1 percent

on the month in April after a 9.2 percent jump in March powered by aircraft

orders. Forecasters expect a decrease of 0.1 percent ex-transportation. Core

capital goods orders are seen flat.

United States Case-Shiller Home Price Index for March (Tue

0900 EDT; Tue 1300 GMT)

Consensus Forecast, 20-City Adjusted - M/M: 0.3%

Consensus Range, 20-City Adjusted - M/M: 0.2% to 0.4%

Consensus Forecast, 20-City Unadjusted - Y/Y: 4.3%

Consensus Range, 20-City Unadjusted - Y/Y: 4.2% to 4.5%

Home prices are seen up 4.3 percent on year in March versus

4.5 percent in February, and up 0.3 percent on the month, seasonally adjusted.

United States Consumer Confidence for May (Tue 1000

EST; Tue 1400 GMT)

Consensus Forecast, Index: 87.3

Consensus Range, Index: 84.0 to 91.3

The consensus looks for a correction upward to a still-gloomy

87.3 in May from 86.0 in April and 93.9 in March.

Wednesday

Australia Monthly CPI for April (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, CPI - Y/Y: 2.2%

Consensus Range, CPI - Y/Y: 1.9% to 2.6%

CPI is expected to show a 2.2 percent rise on year in April

versus 2.4 percent in March.

New Zealand RBNZ Announcement (Wed 1400 NZST; Wed 0200

GMT; Tue 2200 EDT)

Consensus Forecast, Change: -0.25 bp

Consensus Range, Change: -0.25 bp to -0.25 bp

Consensus Forecast, Level: 3.25

Consensus Range, Level: 3.25 to 3.25

Forecasters uniformly expect a 25 basis point rate cut to

3.5 percent for the official cash rate with a signal of more rate cuts ahead.

France GDP for First Quarter (Wed 0845 CEST; Wed 0645

GMT; Wed 0245 EDT)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.1% to 0.1%

Consensus Forecast, Y/Y: 0.8%

Consensus Range, Y/Y: 0.8% to 0.8%

Forecasters see no revision in Q1 GDP from 0.1 percent on

quarter and 0.8 percent on year.

Germany Unemployment Rate for May (Wed 0955 CEST; Wed

0755 GMT; Wed 0355 EDT)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.4%

The jobless rate is expected flat at 6.3 percent.

Thursday

South Korea Bank of Korea Announcement (Thu 1000 KST;

Thu 0100 GMT; Wed 2100 EDT)

Consensus Forecast, Change: 25 bp

Consensus Range, Change: 25 bp to 25 bp

Consensus Forecast, Level: 2.5%

Consensus Range, Level: 2.5% to 2.5%

After holding rates steady at 2.75 percent in April, the BOK

is widely expected to cut rates by 25 basis points at the May meeting to

cushion the economy from the trade shock.

Australia Capital Expenditures for First Quarter (Thu

1130 AET; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: -1.0% to 1.2%

Capex is expected up 0.5 percent on the quarter in Q1 after

declining 0.2 percent in Q4.

United States GDP for First Quarter (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Quarter over Quarter - Annual Rate:

-0.3%

Consensus Range, Quarter over Quarter - Annual Rate: -0.5%

to 0.0%

Consensus Forecast, Personal Consumption Expenditures -

Annual Rate: 1.8%

Consensus Range, Personal Consumption Expenditures -

Annual Rate: 1.6% to 1.8%

No revision is the call from the advance report at minus 0.3

percent.

United States Jobless Claims (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 230 K

Consensus Range, Initial Claims - Level: 225 K to 232

K

Claims are seen at 230 K versus 227 K in the previous week.

United States Pending Home Sales Index for April (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, M/M: -1.1%

Consensus Range, M/M: -1.5% to 0.9%

The consensus looks for home sales retreating by 1.1 percent

after the 6.1 percent jump in March.

Friday

South Korea Industrial Production for April (Fri 0800

KST; Thu 2300 GMT; Thu 1900 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: -0.5% to 0.6%

Output is seen up a strong 0.5 percent on the month.

Japan Tokyo CPI for May (Fri 0830 JST; Thu 2330 GMT; Thu

1930 EDT)

Consensus Forecast, CPI - Y/Y: 3.5%

Consensus Range, CPI - Y/Y: 3.3% to 3.6%

Consensus Forecast, Ex-Fresh Food - Y/Y: 3.5%

Consensus Range, Ex-Fresh Food - Y/Y: 3.3% to 3.6%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.2%

Consensus Range, Ex-Fresh Food & Energy - Y/Y:

3.1% to 3.3%

Consumer inflation in Tokyo, the leading indicator of the

national average, is expected to remain elevated in May after surging in April,

when the price-cutting base-year effect of free high school education in the

capital had waned and after the government had halved its utility subsidies for

the three-month heating season ending in March (bills are paid from February to

April). Processed food prices also stayed high amid the lingering impact of

domestic rice shortages and high import costs.

The core reading (excluding fresh food) is forecast at a

25-month high of a 3.5% rise on year after surging to 3.4% in April from 2.4%

in March. The year-on-year rise in the total CPI is expected to stand at 3.5%

after soaring to a 24-month high of 3.5% from 2.9%. The annual rate for the

core-core CPI (excluding fresh food and energy), which is little affected by

fluctuations in gasoline and heating oil prices, is seen ticking up to 3.2%

after jumping to 3.1% from 2.2%.

Japan Unemployment Rate for April (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.4% to 2.6%

Japanese payrolls are expected to post their 33rd straight

rise on year in April amid chronic shortages of construction workers, truck

drivers and system engineers as well as easing but still tight conditions at

hotels and restaurants. The seasonally adjusted unemployment rate is forecast

to remain low and stable at 2.5% (economist forecasts ranged from 2.4% to 2.6%)

after ticking up to 2.5% in March from 2.4% in February. The 2.4% rate in

September 2024 was the lowest in more than four years since 2.4% in February

2020.

Japan Industrial Production for April (Fri 0850 JST; Thu

2350 GMT; Thu 1950 EDT)

Consensus Forecast, M/M: -1.5%

Consensus Range, M/M: -2.0% to -1.0%

Consensus Forecast, Y/Y: 0.0%

Consensus Range, Y/Y: -1.3% to 0.4%

Japan's industrial production is forecast to post its first

drop in three months in April, down 1.5%, after a slight 0.2% gain (revised up

sharply from -1.1%) in Mach as the impact of the global trade war initiated by

President Trump is expected to start showing in export data.

The monthly survey by the Ministry of Economy, Trade and

Industry released last month indicated that output would slump 2.5% in April

(adjusted for the forecast index's upward bias), pulled down by declines in

electrical/information devices, chemicals and refined petroleum products before

rising 3.9% in May, led by a rebound in autos and electrical/information

equipment.

From a year earlier, factory output is expected to be

unchanged after rising 1.0% (revised up from -0.3%) in March for the third

consecutive gain.

Japan Retail Sales for April (Fri 0850 JST; Thu 2350 GMT;

Thu 1950 EDT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.2% to 0.1%

Consensus Forecast, Y/Y: 2.7%

Consensus Range, Y/Y: 1.9% to 4.3%

Japanese retail sales are forecast to have risen 2.7% on

year in April, with the pace of increase decelerating from 3.1% in March, in

light of a third straight year-on-year drop in department store sales hit by

slower inbound spending. Overall sales appeared to be propped up by higher fuel

prices and recovering new vehicle sales after last year's production suspension

by the Toyota Motor group over safety test scandals.

On the month, retail sales are expected to post their second

straight drop, down a slight 0.2%, after slipping 1.2% in March and edging up

0.4% in February.

Last month, the Ministry of Economy, Trade and Industry

upgraded its assessment for the first time in eight months, saying retail sales

are "on a gradual pickup trend." In the previous five months, sales had been

"taking one step forward and one step back."

Australia Monthly Retail Sales for April (Fri 1130 AET;

Fri 0130 GMT; Thu 2130 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.1% to 0.6%

Sales are expected up by another 0.3 percent after rising

0.3 percent in March.

Germany Retail Sales for April (Fri 0800 CEST; Fri 0600

GMT; Fri 0200 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.5% to 0.3%

Sales expected up 0.2 percent on the month.

Eurozone M2 Money Supply for April (Fri 1000 GMT; Fri

0400 EDT)

Consensus Forecast, Y/Y: 3.7%

Consensus Range, Y/Y: 3.5% to 3.8%

Money supply growth expected at 3.7 percent in April, same

as in March.

India GDP for First Quarter (Fri 1600 IST; Fri 1030

GMT; Fri 0630 EDT)

Consensus Forecast, Y/Y: 6.7%

Consensus Range, Y/Y: 5.8% to 7.5%

Forecasters look for GDP growth at 6.7 percent in Q1 versus

6.2 percent in Q4.

Germany CPI for May (Fri 1400 CET; Fri 1200 GMT; Mon 0800

EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.0% to 2.2%

The consensus looks for CPI to rise 0.2 percent on month and

2.1 percent on year in May after 0.4 percent and 2.1 percent in April.

Canada Monthly GDP for March (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.2% to 0.1%

Forecasters agree with Stats Can's advance estimate that looks

for GDP up 0.1 percent in March. That reflects a rebound in oil output and in

the transportation sector after declines in February,

Canada GDP for First Quarter (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Annual Rate: 1.6%

Consensus Range, Annual Rate: 1.5% to 1.8%

The annual growth rate is expected at 1.6 percent versus 1.5

percent in Q4. The annual growth rate sounds better but it was mostly due to a

strong January and growth faltered after that as trade problems hit.

United States International Trade in Goods (Advance) for

April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Balance: -$143.0 B

Consensus Range, Balance: - $167.3 B to -$110.0 B

After reaching an amazing $162.0 billion deficit in March as

importers stocked up ahead of import tariffs, forecasters see the trade gap at a

still-wide $143.0 billion in April.

United States Personal Income and Outlays for April (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.3%

Consensus Range, Personal Income - M/M: 0.2% to 0.4%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.2%

Consensus Range, Personal Consumption Expenditures - M/M:

0.0% to 0.3%

Consensus Forecast, PCE Price Index - M/M: 0.1%

Consensus Range, PCE Price Index - M/M: 0.1% to 0.1%

Consensus Forecast, PCE Price Index - Y/Y: 2.1%

Consensus Range, PCE Price Index - Y/Y: 2.1% to 2.2%

Consensus Forecast, Core PCE Price Index - M/M: 0.1%

Consensus Range, Core PCE Price Index - M/M: 0.1% to 0.3%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.6%

Consensus Range, Core PCE Price Index - Y/Y: 2.5% to 2.7%

Personal income seen up 0.3 percent, spending up 0.2 percent

on the month. PCE prices seen rising by 0.1 percent on the month and 0.1

percent for the core.

United States Chicago PMI for May (Fri 0945 EDT; Fri 1345

GMT)

Consensus Forecast, Index: 45.0

Consensus Range, Index: 43.0 to 46.0

The call looks for 45.0 in May versus 44.6 in April as a

nasty contraction continues in Chicagoland.

United States Consumer Sentiment for May Final (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 52.0

Consensus Range, Index: 50.8 to 56.0

Forecasters see the index at 52.0 in the final May report

versus a low-low 50.8 in the preliminary report for May.

China CFLP Composite PMI for May (Fri 0930 CST; Fri 0130

GMT; Fri 2130 EDT)

Consensus Forecast, Manufacturing Index: 49.5

Consensus Range, Manufacturing Index: 49.5 to 49.5

Consensus Forecast, Non-Manufacturing Index: 50.2

Consensus Range, Non-Manufacturing Index: 50.2 to 50.2

Manufacturing seen at 49.5 versus 49.0 and non-manufacturing

at 50.2 versus 50.4 in April.

|