|

The Week Ahead: Highlights

Asia-Pacific Preview

Purchasing Managers Reports in Focus amid Trade Tensions

By Brian Jackson, Econoday Economist

The July round of PMI purchasing manager surveys will be the

main focus for the Asia-Pacific data calendar in the week ahead. June surveys

showed a mix of subdued growth and contraction in activity in much of the

region, with respondents continuing to cite the impact of global trade

tensions. Next week's surveys will be closely watched for an early indication

of activity and sentiment over July ahead of the expiry at the start of August

of the 90-day pause on tariff increases announced by the Trump Administration

in April.

Another highlight next week will be monthly and quarterly

inflation data for Australia. At its meeting earlier this month, the

Reserve Bank of Australia unexpectedly left policy rates on hold, with

officials noting that monthly data had indicated that inflation in the three

months to June will be higher than they previously expected. Three of the nine

board members, however, voted for a rate cut at this meeting, and next week's

inflation data may be enough to reassure other members that inflation is on

track to remain close to the middle of their target range of 2 percent to 3

percent.

The Monetary Authority of Singapore will also hold its

quarterly policy review next week. At its previous review in April, officials

announced that they will target a slightly reduced pace of exchange rate

appreciation after they lowered their growth and inflation forecasts. Data

since then have shown core inflation holding at low levels and weak growth in

industrial production, indicating that further policy easing will

likely be considered.

Europe Preview

Trump's August 1 Trade Deadline Looms

By Marco Babic, Econoday Economist

One gets the sense that while some big data releases are

scheduled in Europe in the week ahead, it's almost a case of will anyone care?

The week brings President Trump's August 1 deadline for the European Union and

Switzerland to reach trade deals with the United States.

According to media reports, both the EU and Switzerland are expecting a deal

around tariffs of 10 to 15 percent. Of course, there are skeptics that those

will be the actual levies agreed upon. Granted, much higher tariffs have been

threatened, but it's hard to conclude that climbing down from 25 percent or

more to 10 to 15 somehow counts as a win.

So far, the economic data has been quite resilient even

though some countries have been reporting lower exports to, and imports from,

the US. One of the most surprising developments was that a number of countries

which reporting pessimistic current conditions were positive on the outlook in

twelve months. That has changed over the past few weeks with businesses

becoming glummer about the outlook. Is reality setting in?

What About Inflation?

Last week, the European Central Bank elected to keep policy

rates unchanged and said that it's "determined to ensure that inflation

stabilizes at its 2.0 percent target in the medium term." It went on to say

that the "environment remains exceptionally uncertain, especially because of

trade disputes," while reiterating its data-dependent approach. And here we

are.

Whether 10, 15 or 25 percent, any tariffs are bound to be

inflationary and the question is to what degree? Next week, France, Germany,

and the Eurozone report preliminary consumer prices for July. French annual

inflation was 1.0 percent in June, 2.0 percent in Germany and the Eurozone

which is in the ECB's comfort zone. But for how long?

On Wednesday, Germany, Italy, and the Eurozone report their flash GDP figures

which unfortunately don't contain detailed breakdowns. With the final numbers,

it could be telling to see what the trade contributions are to the overall

result. In the first quarter, Germany's economy didn't expand year-on-year

while the French and Eurozone economies grew 0.7 and 1.5 percent respectively.

Second quarter data didn't provide any real assurances that economic growth

would be any better than it was in the first quarter.

Other indicators scheduled for next week include final

readings for July manufacturing PMI for France, Germany, and the Eurozone.

While not likely to change much from the flash readings, there could be some

anecdotal evidence to provide context.

Ultimately, the focus is on trade negotiations and what, if

any, agreement is made and at what level tariffs are imposed. European auto

manufacturers are reporting that second quarter earnings have been impacted by

tariffs.

US Preview

FOMC Meeting Plus Big Data Week Ahead

By Theresa Sheehan, Econoday Economist

The July 28 week presents a busy economic data calendar as

the month winds down, but it is the FOMC meeting on Tuesday and Wednesday that

will dominate the news cycle.

It is widely anticipated that the meeting will end with no

change in the current fed funds target rate range of 4.25-4.50 percent.

However, it seems likely that the meeting statement issued at 14:00 ET on

Wednesday could include at least one dissenting vote from Governor Christopher

Waller. A recent speech indicated he thinks that the price increases from

tariffs are a one-off and unlikely to lead to persistent inflation. However, a

majority of voters will probably opt for continued caution and hold off on a

rate cut at least until the September 16-17 meeting when the FOMC will have

more data about any lagged effects of higher tariffs. There is no update to the

summary of economic projections (SEP) until the next meeting.

Chair Jerome Powell's press briefing at 14:30 ET on

Wednesday will provide more detail than the statement but his remarks will

adhere closely to its contents. He will probably have to spend much of the time

explaining why the FOMC should not cut rates if the US economy is in expansion

and the labor market remains healthy. Even though it is well established that

Powell will not answer question regarding his position as Fed Chair and the

hostility of the Trump administration, he will be asked about it.

Surrounding the FOMC meeting is a lot of data regarding

labor markets. The FOMC will have in hand the June JOLTS numbers at 10:00 ET on

Tuesday and the ADP National Employment Report for July at 8:15 on Wednesday.

The FOMC will not have the July Challenger report on layoff intentions set for

7:30 ET on Thursday, the weekly data on jobless claims set for release at 8:30

ET on Thursday, or the July monthly data on payrolls and the unemployment rate

at 8:30 ET on Friday.

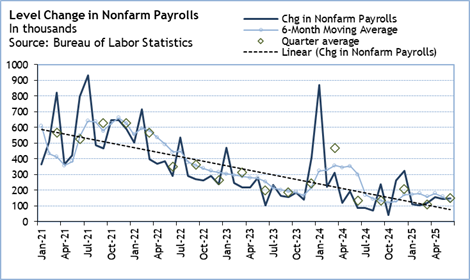

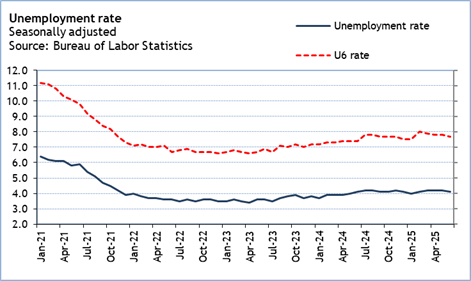

Overall, the labor market data points to weaker hiring

without high levels of layoffs. Fed policymakers are watching for a tipping

point that would signal recession. It could be further weakening in hiring or

outright declines in payrolls even if the unemployment rate doesn't show a

sudden increase of any significance. Businesses may be reluctant to lose

skilled workers that cannot be replaced in a shrinking labor force. The economy

is restructuring as the implications of Trump administration policies become

apparent. Some of this is due to losing workers from harsh immigration

enforcement, some is cutbacks in government jobs and/or funding that are

rippling through the economy, and some is restructuring related to new

technologies.

The monthly employment report for July on Friday is the most

important of the reports on the labor market. July isn't usually a month of

strong hiring after June's graduates start jobs and businesses in leisure and

hospitality have beefed up their workforces. Education job gains generally

don't pick up until August when the school year starts. In part because of the

vacation period, July's report tends to come in a bit under expectations and

then see upward revisions in the next month.

The Week Ahead: Econoday Consensus Forecasts

Monday

United States Dallas Fed Manufacturing Survey for July (Mon

1030 EDT; Mon 1430 GMT)

Consensus Forecast, General Activity Index: -9.0

Consensus Range, General Activity Index: -10.0 to -8.0

The consensus looks for the activity index at minus 9.0 in

July versus minus 12.7 in June, which would suggest ongoing contraction.

Tuesday

United States International Trade in Goods (Advance) for

June (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Balance: -$99.0 B

Consensus Range, Balance: -$130.0 B to -$90.0 B

Forecasters see the deficit at $99.0 billion in May as

imports are down from elevated levels in Q1 that reflected

tariff-front-running.

United States Wholesale Inventories (Advance) for June (Tue

0830 EDT; Tue 1230 GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.1% to 0.2%

The consensus sees inventories flat in June.

United States Case-Shiller Home Price Index for May (Tue

0900 EDT; Tue 1300 GMT)

Consensus Forecast, 20-City Unadjusted - Y/Y: 3.0%

Consensus Range, 20-City Unadjusted - Y/Y: 2.9% to 3.1%

Home prices are seen up 3.0 percent on year in May versus

3.4 percent in April as housing price inflation trends down.

United States Consumer Confidence for July(Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, Index: 95.8

Consensus Range, Index: 93.0 to 100.0

The consensus looks for confidence a bit better at 95.8 in

July versus 93.0 in June and 98.4 in May as tariff and inflation fears have

diminished somewhat.

United States JOLTS for June (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, Job Openings: 7.40 M

Consensus Range, Job Openings: 7.30 M to 7.55 M

Job openings expected down at 7.400 million in June versus

7.769 million in May. That reflects more cautious hiring.

Wednesday

Australia Monthly CPI for June (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, CPI - Y/Y: 2.1%

Consensus Range, CPI - Y/Y: 2.1% to 2.3%

No change expected in annual CPI at 2.1 percent in the

monthly reading from the May annual rate.

Australia CPI for Second Quarter (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.7% to 0.9%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 2.2% to 2.3%

Q2 CPI inflation expected to slow marginally to 0.8 percent

on quarter and 2.2 percent on year versus 0.9 percent on quarter and 2.4

percent on year in Q1.

Germany Retail Sales for June (Wed 0800 CEST; Wed 0600

GMT; Wed 0200 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.3% to 0.5%

Sales expected to rebound by 0.5 percent on the month after

falling 1.6 percent in May.

Germany GDP Flash for Second Quarter (Wed 1000 CEST;

Wed 0800 GMT; Wed 0400 EDT)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: -0.2% to 0.2%

Consensus Forecast, Y/Y: 0.2%

Consensus Range, Y/Y: 0.1% to 0.4%

After rising 0.4 percent in Q1 on quarter, the forecast for

the Q2 flash looks for no change from Q1. The consensus sees GDP up 0.2 percent

on year.

Eurozone EC Consumer Sentiment for July (Wed 1100

CEST; Wed 0900 GMT; Wed 0500 EDT)

Consensus Forecast, Economic Sentiment: 94.1

Consensus Range, Economic Sentiment: 93.6 to 94.5

Consensus Forecast, Industry Sentiment: -11.1

Consensus Range, Industry Sentiment: -13.0 to -11.0

Consensus Forecast, Consumer Sentiment: -14.7

Consensus Range, Consumer Sentiment: -14.7 to -14.7

Economic sentiment expected at 94.1 for July versus 94.0 in

the previous report. Industry sentiment seen at minus 11.1 versus minus 12.0

Consumer sentiment seen at minus 14.7 versus minus 15.3.

Eurozone GDP Flash for Second Quarter (Wed 1100 CEST;

Wed 0900 GMT; Wed 0500 EDT)

Consensus Forecast, Q/Q: -0.1%

Consensus Range, Q/Q: -0.2% to 0.3%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.1% to 1.3%

Growth seen at minus 0.1 percent on the quarter for Q2 and up

1.2 percent on year.

United States ADP Employment Report for July (Wed 0815

EDT; Wed 1215 GMT)

Consensus Forecast, Private Payrolls - M/M: 80 K

Consensus Range, Private Payrolls - M/M: 20 K to 130

K

The consensus sees private payrolls up by a moderate 80K in

July after falling 33k in June.

United States GDP for Second Quarter (Wed 0830 EDT; Wed

1230 GMT)

Consensus Forecast, Quarter over Quarter - Annual Rate:

2.5%

Consensus Range, Quarter over Quarter - Annual Rate: 1.0%

to 3.8%

Consensus Forecast, Personal Consumption Expenditures -

Annual Rate: 1.3%

Consensus Range, Personal Consumption Expenditures -

Annual Rate: 0.9% to 1.4%

Growth expected at 2.5 percent rate in the first look at Q2

after falling by 0.5 percent in Q1. PCE growth seen at 1.3 percent versus an

anemic 0.5 percent in Q1. Net exports expected to boost the 2Q figure as

imports surged in Q1 and fell back in Q2. Consumer spending remains soft.

Canada Bank of Canada Announcement (Wed 0945 EDT; Wed

1345 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 2.75%

Consensus Range, Level: 2.75% to 2.75%

Forecasters expect the bank to leave rates on hold at 2.75

percent as they did April and June. The economy has been holding up fairly

well with the job market showing signs of stabilizing while inflation has been

unexpectedly sticky. And that trade war just hasn't hit as hard as feared.

United States Pending Home Sales Index for June (Wed 0830

EDT; Wed 1230 GMT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.0% to 0.9%

The consensus looks for a rise of 0.5 percent in June on the

month after a 1.8 percent increase in May.

United States FOMC Announcement (Wed 1400 EDT; Wed 1800

GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Federal Funds Rate - Target Range:

4.25% to 4.50%

Consensus Range, Federal Funds Rate - Target Range: 4.25%-4.50%

to 4.25%-4.50%

No action expected as the FOMC majority waits for more

clarity on tariff effects. Seems likely that Governors Waller and Bowman will

dissent in favor of a 25 bp cut.

Thursday

Japan Industrial Production for Jun (Thu 0850 JST; Wed

2350 GMT; Wed 1950 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -1.0% to 0.7%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 1.3% to 5.3%

Key forecast points:

--Japan's industrial production is expected to be little

changed, up just 0.1% on the month in June (forecast range: -1.0% to +0.7% vs.

METI's projection -1.9%) after being also nearly flat in May with a 0.1% dip

(revised down from a slight 0.5% rebound) amid lingering global trade rows and

heightened geopolitical risks in the Middle East. Factory output is seen up

2.1% on the year after slumping 2.4% in May (revised down from -1.8%), which

was the first drop in five months.

--The Ministry of Economy, Trade and Industry is likely to

maintain its assessment (the last change was an upgrade in July 2024), saying

industrial output is "taking one step forward and one step back."

Japan Retail Sales for May (Thu 0850 JST; Wed 2350 GMT;

Wed 1950 EDT)

Consensus Forecast, M/M: 1.1%

Consensus Range, M/M: 0.2% to 1.4%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 1.7% to 3.0%

Key forecasts:

--Japanese retail sales are forecast to show a modest 2.2%

rise on the year in June, little changed from +1.9% in May (revised down from

+2.2%) and slowing sharply from +3.5% in April as department store sales

suffered a fifth straight drop, hit by lower inbound spending amid a firmer yen

and stricter duty-free shopping rules. Continued solid demand for drugs and

cosmetics are propping up retail sales. New vehicle sales are on a gradual

recovery trend after last year's production suspension by the Toyota Motor

group over safety test scandals.

--Retail sales are seen up a solid 1.1% on year after

slipping 0.6% in May (revised down from -0.2%) and rising 0.7% in April.

China CFLP Composite PMI for July (Thu 0930 CST; Thu 0130

GMT; Wed 2130 EDT)

Consensus Forecast, Manufacturing Index: 49.7

Consensus Range, Manufacturing Index: 49.6 to 49.9

Consensus Forecast, Non-Manufacturing Index: 50.4

Consensus Range, Non-Manufacturing Index: 50.3 to

50.5

Manufacturing expected unchanged at 49.7 in July while

non-manufacturing is almost flat at 50.4 from 50.5 in June.

Australia Monthly Retail Sales for June (Thu 1130 AET;

Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 1.0%

Another modest increase of 0.3 percent is the call for June

after rising 0.2 percent in May.

Japan Bank of Japan Announcement (Thu 1130 JST; Thu 0800

GMT; Wed 0400 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0bp to 0bp

Consensus Forecast, Level: 0.5%

Consensus Range, Level: 0.5% to 0.5%

--The Bank of Japan's nine-member board is widely expected

to vote unanimously to maintain the target for the overnight interest rate at

0.5% for the fourth straight meeting amid uncertainty over the trade war and

geopolitical risks. Tokyo and Washington agreed on 15% tariffs on most U.S.

imports of Japanese goods (50% on iron and steel), lower than President Trump's

original plan to slap 25% duties on Japan, but the figure is still much higher

than the 2.5% rate imposed by the United States before the second Trump

administration.

--No change in the bank's policy stance would follow the

previous meeting on April 30-May 1 when the board decided in an 8 to 1 vote to

moderate the JGB purchase reduction pace to by about ¥200 billion a quarter in

fiscal 2026 starting in April from by about ¥400 billion now, which will still

reduce the pace of its JGB buying to around ¥2.1 trillion in January-March 2027

from about ¥4.1 trillion in January-March 2027.

--Governor Kazuo Ueda is expected to repeat that the bank

will continue raising rates "gradually" as part of its policy normalization

process that began in March 2024.

Germany Unemployment Rate for July (Thu 0955 CEST; Thu

0755 GMT; Thu 0355 EDT)

Consensus Forecast, Rate: 6.4%

Consensus Range, Rate: 6.3% to 6.4%

The consensus looks for unemployment to tick up to 6.4

percent in July from 6.3 percent in June.

Eurozone Unemployment Rate for June (Thu 1100 CEST; Thu

0900 GMT; Thu 0500 EDT)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.2% to 6.3%

No change from 6.3 percent is the call.

Germany CPI for July (Thu 0800 CEST; Thu 0600 GMT; Thu

0200 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.2%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 1.7% to 2.0%

Consensus Forecast, HICP - M/M: 0.1%

Consensus Range, HICP - M/M: 0.1% to 0.4%

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: 1.9% to 2.0%

CPI expected up 0.1 percent on the month in July versus 0.0

percent in June. On year, expectations call for the same increase of 2.0 percent

as in June.

Canada Monthly GDP for May (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.3% to -0.1%

Another sluggish showing expected, down 0.1 percent, in line

with the Stats Canada projection. Forecast reflects a decline in manufacturing

and retail business offset by an increase in wholesale trade.

United States Jobless Claims for Week 7/26 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 223 K

Consensus Range, Initial Claims - Level: 220 K to 225

K

Claims expected back up at 223 K, closer to the 4-week

moving average of 225K, after falling a more than expected 4K to 217K in the

previous week.

United States Personal Income and Outlays for June (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.3%

Consensus Range, Personal Income - M/M: 0.0% to 0.5%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.4%

Consensus Range, Personal Consumption Expenditures - M/M:

0.1% to 0.6%

Consensus Forecast, PCE Price Index - M/M: 0.3%

Consensus Range, PCE Price Index - M/M: 0.3% to 0.3%

Consensus Forecast, PCE Price Index - Y/Y: 2.5%

Consensus Range, PCE Price Index - Y/Y: 2.5% to 2.5%

Consensus Forecast, Core PCE Price Index - M/M: 0.3%

Consensus Range, Core PCE Price Index - M/M: 0.2% to

0.3%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.7%

Consensus Range, Core PCE Price Index - Y/Y: 2.7% to

2.8%

Personal income expected up 0.3 percent and spending up 0.4

percent on the month. Spending has been bolstered by store sales to offset

weakness in autos. PCE prices expected up 0.3 percent on the month for total

and core. Not the kind of inflation number to encourage faster US fate cuts

with inflationary tariff effects expected to rise as the year goes on.

United States Employment Cost Index for Second Quarter (Thu

0830 EST; Thu 1230 GMT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.8% to 0.9%

ECI expected up 0.8 percent on quarter versus 0.9 percent in

Q1.

United States Chicago PMI for July (Thu 0945 EDT; Thu

1345 GMT)

Consensus Forecast, Index: 42.0

Consensus Range, Index: 40.5 to 43.0

More of the same here as the consensus looks for 42.0 versus

40.4 in June.

Friday

Japan Unemployment Rate for June (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.4% to 2.6%

--The seasonally adjusted unemployment rate in Japan is

forecast to stay low and stable at 2.5% in June vs. 2.5% the previous three

months and 2.4% in February. Payrolls seen up on year for the 35th straight

month amid widespread labor shortages. Other data show real wages are falling

amid high costs of living.

China PMI Manufacturing for July (Fri 0945 CST; Fri 0145

GMT; Thu 2345 EDT)

Consensus Forecast, Index: 50.6

Consensus Range, Index: 49.5 to 50.8

The consensus sees the index at 50.6 in July versus 50.4 in

June.

Eurozone HICP Flash for July (Fri 1100 CEST; Fri 0900

GMT; Fri 0500 EDT)

Consensus Forecast, HICP - Y/Y: 1.9%

Consensus Range, HICP - Y/Y: 1.7% to 1.9%

Consensus Forecast, Narrow Core - Y/Y: 2.3%

Consensus Range, Narrow Core - Y/Y: 2.2% to 2.3%

HICP seen at 1.9 percent on year in the July flash versus

2.0 percent in June final. Narrow core expected unchanged at 2.3 percent.

US Employment Situation for July (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 102K

Consensus Range, Nonfarm Payrolls - M/M: 0 K to 140K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.2% to 4.2%

Consensus Forecast, Private Payrolls - M/M: 94K

Consensus Range, Private Payrolls - M/M: 55K to 125K

Consensus Forecast, Manufacturing Payrolls - M/M: 1K

Consensus Range, Manufacturing Payrolls - M/M: 0 K to

3 K

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2%

to 0.3%

Consensus Forecast, Average Workweek: 34.2

Consensus Range, Average Workweek: 34.2 to 34.2

Payrolls expected up 102K in July, down from 147K in June as

hiring tapers off. The jobless rate is expected to tick up to 4.2 percent from

4.1 percent in June.

United States ISM Manufacturing Index for July (Fri 0945

EDT; Fri 1345 GMT)

Consensus Forecast, Index: 49.8

Consensus Range, Index: 48.2 to 52.0

ISM manufacturing expected to edge up to 49.8 in July,

barely in contraction, from 49.0 in June.

United States Construction Spending for June (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.1%

Spending is expected to recover by only 0.1 percent in June

after declining 0.3 percent in May.

United States Consumer Sentiment for July (Fri 1000 EDT;

Fri 1400 GMT)

Consensus Forecast, Index: 61.8

Consensus Range, Index: 61.0 to 63.5

Consensus Forecast, Year-ahead Inflation Expectations: 4.4%

Consensus Range, Year-ahead Inflation Expectations: 4.4%

to 4.5%

The sentiment index is expected unrevised at 61.8 for the

July final from the flash. This would be well up from the April low of 52.2 and

up from 60.7 in the June final.

|