|

The Week Ahead: Highlights

Asia-Pacific Preview

Reserve Bank of India Rate Decision in Focus

By Brian Jackson, Econoday Economist

The Reserve Bank of India policy decision will be the main

focus of the Asia-Pacific economic calendar in the week ahead. The RBI cut

rates by 50 basis points at its last meeting in June, a move bigger than the 25

basis point cut expected. Officials then cited the "benign" outlook for

inflation and said this warranted aggressive policy support to "step up the

growth momentum." Data since then have shown a further fall in headline

inflation from 2.82 percent in May to a six-year low of 2.1 percent in June, while

headline growth in industrial production has slowed. However, having already

lowered rates by 100 basis point since the start of the year, officials next

week may decide that additional easing can wait.

This month's round of PMI surveys will also continue early next week. Surveys released far show stronger momentum in India's manufacturing sector but subdued conditions elsewhere in the region. Uncertainty about global trade conditions continue to weigh on activity and sentiment in the region ahead scheduled increases in tariffs by the Trump Administration this month.

Australia will report data on household spending and trade ahead of the next policy meeting by the Reserve Bank of Australia the following week. With CPI data published this week showing a moderation in underlying inflation, next week's data could be enough to convince officials that further policy easing is warranted. New Zealand also reports quarterly labour market data next week.

Europe Preview

In the Trade Twilight Zone

By Marco Babic, Econoday Economist

Trade is the main focus in the week ahead, coming just after

the EU and US concluded a framework deal on tariffs. Although the US is

imposing 15 percent duties on goods from Europe broadly speaking, the details

remain thin. According to some observers, the agreement gives businesses a

framework from which they can plan. But can they?

Some recent sentiment surveys showed that businesses that were optimistic about their prospects in 12 months are suddenly less so. If there is any doubt that that tariffs are biting, one only has to look at some of the comments in the reports of German automakers.

Germany, Europe's largest economy, reports June trade figures on Thursday. In May, it recorded a surplus of 18.4 billion euros as imports fell 3.0 percent and exports dropped 1.4 percent. Tariffs will weigh very heavily on Germany's auto sector and something that will likely manifest in the third quarter numbers. France releases its trade results as well and reported a 7.77 billion deficit in May.

The industrial sector is also on the marquee next week with France, Germany, and Italy reporting on how their factories performed in June. German production surprisingly increased in May, gaining 1.2 percent on monthly and annual comparisons. But like much of the data coming out, one has to ask is because businesses are pushing up output before tariffs hit. Production in France and Italy was down in May and PMI data hasn't given any indication there is a recovery on the horizon.

Since trade data has a relatively long lag time in reporting, we are in somewhat of a twilight zone to gauge the effects of tariffs. For the most part, global container shipping volumes were steady in June, with the RWI Container Throughput Index at 136.5 in June compared to 136.4 in May. However, Norther European ports which saw a rebound in activity in May, saw activity fall to 116.8 from 115.5 in May. This adds some credence to the argument about businesses pushing up their procurement. At the same time, activity at China's usually bustling ports was also mostly steady at 151.2 versus 151.3.

We only have part of the trade picture from the data, and there are still a number of major trading partners that still have not reached a deal with the US, primarily China and Canada. But the longer the uncertainly and lack of policy clarity drags on, the more it will weigh on global trade.

US Preview

After Nonfarm Payrolls Shock, Markets Watching Jobs Data

By Theresa Sheehan, Econoday Economist

The economic data calendar for the August 4 week is sparse.

There will be plenty of time to mull over the shocker that was the monthly

employment report for July. The 73,000 rise in nonfarm payrolls was somewhat

less than the Econoday consensus of up 110,000. However, the net downward

revision of 258,000 to the prior two months alters the outlook for monetary

policy considerably.

Given the tension in the Fed's dual mandate for maximum

employment and price stability, every scrap of information about the labor

market, inflation, and inflation expectations is going to carry some weight. If

the labor market is significantly weaker than previously thought, the odds of a

rate cut at the September 17-18 FOMC are much higher, especially if inflation

reports do not reflect more than incremental upward price pressures.

If hiring has been weak, layoffs have not been rising.

Businesses are not letting go of workers with needed skills and experience who

may be hard and costly to replace later. However, if the US economy is

downshifting and/or new tariffs are requiring cost cuts, layoffs may not be far

behind. The Challenger report on layoff intentions for July showed a 29.3

percent increase to 62,075 in July. While some of the job cuts will be in

unfilled positions, and some at a more distant time, the intention for outright

layoffs has increased.

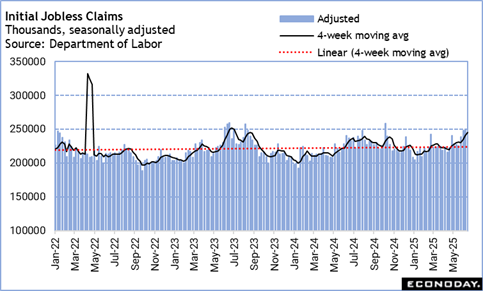

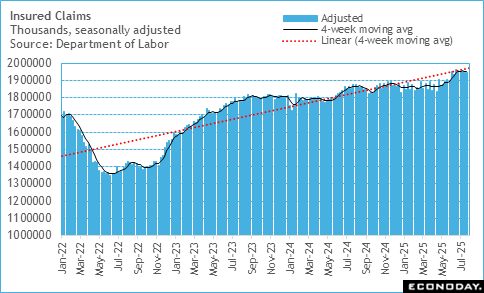

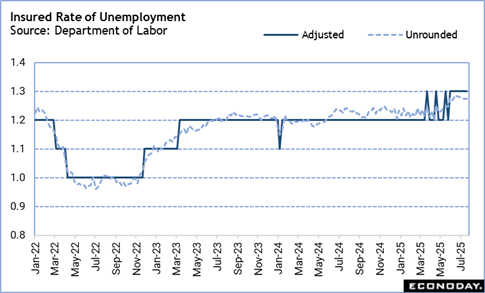

The data on initial jobless claims in the August 2 week

probably won't be much different than the underlying trend in recent weeks as

seen in the four-week moving average of 221,000 in the July 26 week. However,

the number of new filings is showing some upward pressure while the length of

stay on the unemployment rolls is longer.

The Week Ahead: Econoday Consensus Forecasts

Monday

United States Motor Vehicle Sales for July (ANYTIME)

Consensus Forecast, Total Vehicle Sales - Annual Rate:

15.6 M

Consensus Range, Total Vehicle Sales - Annual Rate: 15.1

M to 16.0 M

Sales expected somewhat better at a 15.6 million unit rate

versus 15.3 million in June.

United States Factory Orders for June (Mon 1000 EDT; Mon

1400 GMT)

Consensus Forecast, M/M: -5.0%

Consensus Range, M/M: -6.0% to -4.2%

Orders seen down 5.2 percent in June reflecting a 9.3

percent plunge in durable goods orders reported last week for June. Volatile

aircraft orders continue skewing the report.

Tuesday

South Korea CPI for July (Tue 0800 KST; Mon 2300 GMT;

Mon 1900 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.0% to 2.2%

CPI expected to show increases of 0.2 percent on month and 2.1

percent on year versus 0.0 percent and up 2.2 percent, respectively, in June.

Australia Household Spending for June (Tue 1130 AET; Tue

0130 GMT; Mon 2130 EDT)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.3% to 1.2%

Spending seen up 0.7 percent in June on the month after rising

0.9 percent in May.

France PMI Composite Final for July (Tue 0950 CEST; Tue

0750 GMT; Tue 0350 EDT)

Consensus Forecast, Composite Index: 49.6

Consensus Range, Composite Index: 49.6 to 49.6

Consensus Forecast, Services Index: 49.7

Consensus Range, Services Index: 49.7 to 49.7

No change from the flash at 49.6 is the call for the July

composite final, up slightly from 49.2 in the June final. No change is expected

from the flash at 49.7 for services versus 49.6 in the June final.

Germany PMI Composite Final for July (Tue 0955 CEST; Tue

0755 GMT; Tue 0355 EDT)

Consensus Forecast, Composite Index: 50.3

Consensus Range, Composite Index: 50.3 to 50.3

Consensus Forecast, Services Index: 50.1

Consensus Range, Services Index: 50.1 to 50.1

No change from the flash at 50.3 is the call for the July

composite final, nearly flat from 50.4 in the June final. No change is expected

from the flash at 50.1 for services versus 49.7 in the June final.

Eurozone PMI Composite Final for July (Tue 1000 CEST;

Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Composite Index: 51.0

Consensus Range, Composite Index: 51.0 to 51.0

Consensus Forecast, Services Index: 51.2

Consensus Range, Services Index: 51.2 to 51.2

No change from the flash at 51.0 is the call for the July

composite final, versus 50.6 in the June final. No change is expected from the

flash at 51.2 for services versus 50.5 in the June final.

United Kingdom PMI Composite Final for July (Tue 0930

BST; Tue 0830 GMT; Tue 0430 EDT)

Consensus Forecast, Composite Index: 51.0

Consensus Range, Composite Index: 51.0 to 51.0

Consensus Forecast, Services Index: 51.2

Consensus Range, Services Index: 51.2 to 51.2

No change from the flash at 51.0 is the call for the July

composite final, down from 52.0 in the June final. No change is expected from

the flash at 51.2 for services versus 52.8 in the June final.

Canada Merchandise Trade for June (Tue 0830 EDT; Tue 1230

GMT)

Consensus Forecast, Balance: -C$5.7 B

Consensus Range, Balance: -C$6.5 B to -C$1.6 B

After a C$5.9 billion deficit in May, a C$5.7 deficit is the

call for June.

United States International Trade in Goods and Services

for June (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Balance: - $61.5 B

Consensus Range, Balance: -$72.0 B to -$60.0 B

The trade gap in goods and services is expected at $61.5

billion for June after the goods trade deficit dropped to $86.0 billion in June

amid falling imports.

United States PMI Composite Final for July (Tue 0945

EDT; Tue 1345 GMT)

Consensus Forecast, Composite Index: 54.6

Consensus Range, Composite Index: 54.6 to 54.6

Consensus Forecast, Services Index: 55.2

Consensus Range, Services Index: 55.2 to 55.2

No change from the flash at a robust 54.6 is the call for

the July composite final, up from 52.9 in the June final. No change is expected

from the flash at 55.2 for services versus 52.9 in the June final.

United States ISM Services Index for July (Tue 1000

EDT; Tue 1400 GMT)

Consensus Forecast, Index: 51.5

Consensus Range, Index: 51.0 to 52.2

Services is expected to show very slow expansion continued

in July with the index firmer at 51.5 versus 50.8 in June.

Wednesday

New Zealand Labour Market Conditions for Second Quarter (Wed

1045 NZST; Tue 2245 GMT; Tue 1845 EDT)

Consensus Forecast, Q/Q: -0.2%

Consensus Range, Q/Q: -0.3% to -0.2%

Consensus Forecast, Unemployment Rate: 5.3%

Consensus Range, Unemployment Rate: 5.2% to 5.3%

A weak reading for employment in Q2 with the employment

index expected down 0.2 percent for Q2 on the quarter after rising 0.1 percent

in Q1. The consensus sees the unemployment rate at 5.3 percent in Q2, up from

5.1 percent in Q1.

Germany Manufacturing Orders for June (Wed 0800 CEST;

Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast, M/M: 1.2%

Consensus Range, M/M: 0.5% to 2.0%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 1.5% to 3.1%

Orders are expected to rebound by 1.2 percent on the month in

June after a big 1.4 percent drop in May. The consensus sees orders up only 2.1

percent on the year after rising 5.6 percent on year in May.

Eurozone Retail Sales for June (Wed 1100 CEST; Wed

0900 GMT; Wed 0500 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.2% to 1.5%

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 1.9% to 2.7%

Sales are expected up 0.4 percent on the month and up 2.6

percent on year in June after slipping by 0.7 percent on the month and rising

1.8 percent on year in May.

Thursday

Australia International Trade in Goods for June (Thu 1130

AET; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Balance: A$3.7 B

Consensus Range, Balance: A$2.0 B to A$6.8 B

Trade surplus expected wider at A$3.7 billion in June from

A$2.4 billion in May.

China Merchandise Trade for July (ANYTIME)

Consensus Forecast, Balance of Trade: $103.4 B

Consensus Range, Balance of Trade: $100.7 B to $111.0

B

The trade surplus is expected at $103.4 billion, down from

$114.8 billion in June.

India Reserve Bank of India Announcement (Thu 1000

IST; Thu 0430 GMT; Thu 0030 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Level: 5.50%

Consensus Range, Level: 5.25% to 5.50%

The consensus calls for the RBI to wait for more data on

whether the economy is really slowing. The bank cut rates by a larger than

expected 50 basis points in June and so will hold its fire this time, most

forecasters say.

Switzerland Unemployment Rate for July (Thu 0745 CEST;

Thu 0545 GMT; Thu 0145 EDT)

Consensus Forecast: 2.9%

Consensus Range: 2.9% to 2.9%

No change expected in the jobless rate at 2.9 percent,

seasonally adjusted.

Germany Industrial Production for June (Thu 0800 CEST;

Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -1.0% to -0.5%

Output expected to fall back by 0.5 percent on the month

after jumping 1.2 percent in May.

United Kingdom BoE Announcement & Minutes (Thu

1200 BST; Thu 1100 GMT; Thu 0700 EDT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 4.00%

Consensus Range, Level: 4.00% to 4.00%

Most forecasters see a 25 bp cut in the bank rate given

lackluster growth. Markets expect another three-way split with some MPC members

voting for 50 basis points and some favoring no action at all.

United States Jobless Claims for Week of August 2 (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 220 K

Consensus Range, Initial Claims - Level: 217 K to 225

K

Claims seen at 220K, closer to the 4-week moving average, up

from 218K last week.

United States Productivity and Costs for Second Quarter (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate:

1.9%

Consensus Range, Nonfarm Productivity - Annual Rate: -0.8%

to 2.5%

Consensus Forecast, Unit Labor Costs - Annual Rate: 2.1%

Consensus Range, Unit Labor Costs - Annual Rate: 1.3%

to 5.0%

Productivity is seen up 1.9 percent in Q2 at an annual rate

versus a decrease of 1.5 percent in Q1. Unit labor costs are seen rising a more

trend-like 2.1 percent after 6.6 percent in Q1.

Canada Ivey PMI for July (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast, Adjusted Index: 53.5

Consensus Range, Adjusted Index: 52.8 to 55.2

The consensus sees the index remaining in expansion at 53.5

from 53.3 in June.

United States Wholesale Inventories (Preliminary) for

June (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

No revision expected in the revised figure from an increase

of 0.2 percent in the flash.

United States Consumer Credit for June (Thu 1500 EDT;

)

Consensus Forecast, $ Bln: $7.5 B

Consensus Range, $ Bln: $7.0 B to $16.0 B

The consensus sees consumer credit up $7.5 billion in June

after a modest $5.1 billion increase in May.

Friday

Japan Household Spending for June (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, M/M: -2.0%

Consensus Range, M/M: -4.4% to -0.1%

Consensus Forecast, Y/Y: 3.1%

Consensus Range, Y/Y: -1.1% to 5.4%

Key forecast points:

--Japan's real average expenditures by households with two

or more people is forecast to risen a modest 3.1% on the year in June amid

slightly easing inflation and a relentless heat wave. It would follow a 4.7%

rise in May, which was mainly driven by vehicle purchases, a volatile factor,

but was also backed by a continued post-pandemic pickup in eating out and a

surge in demand for air conditioners amid early summer heat and humidity. Those

two factors likely led spending in June.

--Seasonally adjusted spending is seen down 2.0% on the

month after rebounding 4.6% in May, plunging 1.8% in April and rising 0.4% in

March.

Canada Labour Force Survey for July (Fri 0830 EDT; Fri

1230 GMT)

Consensus Forecast, Employment - M/M: 7K

Consensus Range, Employment - M/M: -15K to 15K

Consensus Forecast, Unemployment Rate: 7.0%

Consensus Range, Unemployment Rate: 6.9% to 7.0%

After a blowout increase of 83K in June, the job market is

expected to resume its usual sluggishness with a gain of 7K in July.

Unemployment, accordingly, is seen ticking back up to 7.0 percent from 6.9

percent.

|