|

Reserve Bank of New Zealand

Expected to Keep Rates on Hold

By Brian Jackson, Econoday Economist

The Reserve Bank of New Zealand's first policy meeting for

2026 will be the focus in the Asia-Pacific region in the week ahead. Officials

cut policy rates by a cumulative 300 basis points over 2025, including a 25

basis point reduction at their last meeting in December. Before that meeting,

officials had said they remained "open" to cutting further, but in December

they merely noted that future decisions will depend on incoming data. Since

then, data have shown inflation increase slightly above the target range of two

percent to three percent in the last quarter of 2025, likely supporting the

case for no change.

Key Australian data are also scheduled for release.

Quarterly wage data and monthly labour market data will be watched closely by

officials at the Reserve Bank of Australia. Their decision to raise policy

rates earlier this month reflected an assessment that "capacity pressures

are greater than previously assessed and labour market conditions are a little

tight." Singapore trade data and Indian wholesale price data will also be

released.

Europe's Biggest Event Next Week

isn't Economic Data

By Marco Babic, Econoday Economist

The week ahead in Europe sees trade data for Italy and

Belgium for December while the Swiss report their January results. This will

provide an opportunity to look back at what has been, to say the least, a

tumultuous year amidst US tariffs.

European leaders have been slow to come to the realization

that attempting to appease the US has not gone well. But that could be

changing. As a result, perhaps the most important event taking place isn't a

stack of economic indicators, but rather the Munich security conference.

While not completely aligned on policy or approach - it

wouldn't it be Europe if it was - there seems to be at least a broad

realization that the way things were are not how they are going to be. Picking

up on where Canadian Prime Minister Mark Carney left off in Davos, France's

Emmanuel Macron and Germany's Friederich Merz are making strong cases for

Europe to forge its own path. That could include accelerating rearmament and

stepping up European military coordination. Other voices call for more dialogue

with the US, but both things could also be true at once.

At the same time, there was a rebuke to President Trump in

the US Congress where the House voted to allow action to repeal the tariffs on

Canada, with a few Republicans joining Democrats to pass the measure. While

that will hardly drive the Canadians back into the arms of the United States,

it does signal that there could be some rapprochement. In any case, Trump is expected

to veto it.

The tone set at the Munich conference will give some idea of

the degree to which Europe will forge a divergent path from the US and engage

in Realpolitik with China to one degree or another. While this is a security

conference, economic issues will also factor heavily, particularly if

governments are going to spend more on defense.

This is certainly a far cry from the early post-cold war

years when the talk was about peace dividends and disarmament.

Retail Sales, GDP Lead

Holiday-Shortened Week

By Theresa Sheehan, Econoday Economist

The February 16 week starts off with a federal holiday on

Monday to observe Presidents Day. This will mean a full close for bond and

stock markets.

The data release schedule still reflects disruptions from

the federal government shutdown of October 1-November 12.

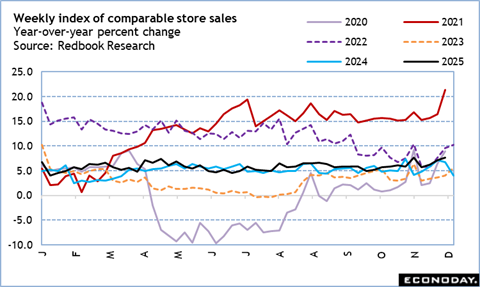

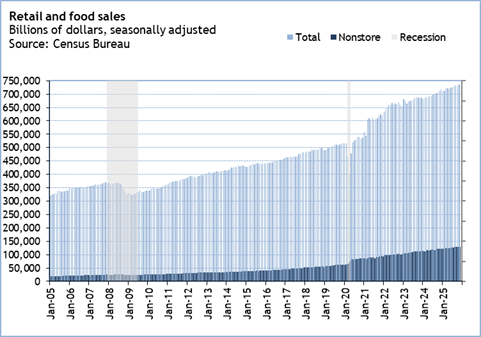

The data on retail and food services sales at 8:30 ET on

Tuesday will be for December. The January report release date is still to be

determined according to the Census Bureau. The December report will provide

information about the pace of consumer spending during the winter shopping

season. The November report showed a 0.6 percent increase in total sales.

December is expected to see a smaller increase but should nonetheless end the

year on a solid up note.

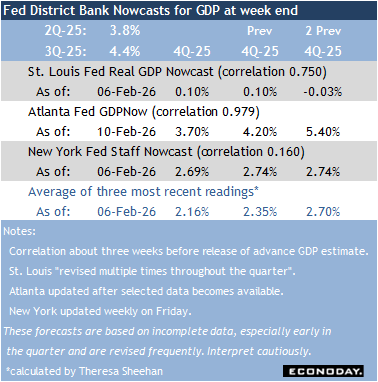

Strong consumer spending should mean that the advance

estimate of fourth quarter GDP will likely be above 2 percent when the numbers

are released on Friday at 8:30 ET. Some of the volatility introduced by the

shutdown - in particular for net exports - should have settled down.

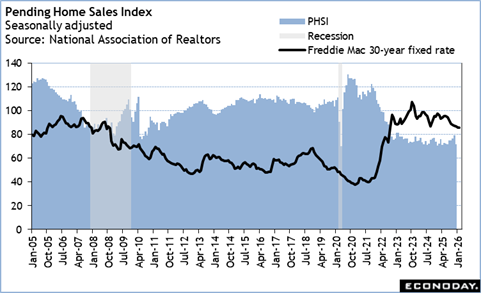

The numbers for existing home sales in January were

disappointing, although the weather may have played an important role in the

8.4 percent decline in sales to it weakest pace in nearly three years. The NAR

pending home sales index for January at 10:00 ET on Thursday is also likely to

be a weather story as buyer traffic was severely limited during the bitter cold

and heavy snowfall. Mortgage rates are on the decline which should help sales

in the coming spring shopping season, but for now homebuyers will be watching

listings and waiting for milder weather.

Japan GDP for Fourth Quarter (Mon 0850 JST; Sun 2350

GMT; Sun 1850 EST)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.2% to 0.6%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.3% to 1.1%

Backed by gains in capital investment, gradual rises in

exports, and continuing modest recovery in private consumption, Japan's real

gross domestic product is expected to rebound and post its first positive

growth in two quarters in the October-December period, following a sharp

contraction in the previous quarter. Still, the recovery lacks clear drivers,

as both capital expenditure and consumption remain short of strong momentum,

with prices continuing to trend higher.

Preliminary Q4 GDP data due from the Cabinet Office at 8:50

a.m. JST on Monday, Feb. 16 (2350 GMT/1850 EST, Sunday, Feb. 15), is forecast

to rise 0.4 percent from the previous quarter, or an annualized gain of 1.7

percent, after falling 0.6 percent, or an annualized drop of 2.3 percent, in

the July-September period, which marked the first contraction in six quarters.

Consensus forecasts for key components in percentage change

on quarter except for domestic demand, private inventories and net exports,

whose contributions are in percentage points. Figures in the previous quarter

are in parentheses:

GDP q/q: +0.4% (-0.6%); 1st rise in 2 qtrs

GDP annualized: +1.7% (-2.3%); 1st rise in 2 qtrs

GDP y/y: +0.9% (+0.6%); 6th straight rise

Domestic demand: +0.4 point (-0.4 point); 1st rise in 2 qtrs

Private consumption: +0.2% (+0.2%); 7th straight rise

Business investment: +0.7% (-0.2%); 1st rise in 2 qtrs

Public investment: -0.3% (-1.1%); 3rd straight drop

Private inventories: -0.1 point (-0.1 point); 2nd straight

drop

Net exports (external demand): +0.1 point (-0.2 point), 1st

rise in 2 qtrs

Eurozone Industrial Production for December (Mon 1100

CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, M/M: -1.2%

Consensus Range, M/M: -1.6% to 0.2%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 1.7% to 2.2%

The consensus sees output faltering at year end just when

things were looking up in the fall. Forecasters see output down 1.2 percent on

month and up 2.0 percent on year in December after gains of 0.7 percent and 2.5

percent in November.

Canada Housing Starts for January (Mon 0815 EST; Mon

1315 GMT)

Consensus Forecast, Annual Rate: 265K

Consensus Range, Annual Rate: 255K to 285K

Starts expected to fall back to a 265K annual rate in

January after rising to 282K in December.

Canada CPI for January (Mon 0830 EST; Mon 1330 GMT)

Consensus Forecast, CPI - M/M: 0.2%

Consensus Range, CPI - M/M: 0.1% to 0.3%

Consensus Forecast, CPI - Y/Y: 2.4%

Consensus Range, CPI - Y/Y: 2.3% to 2.6%

CPI expected up 0.2 percent on month in January and 2.4

percent on year after decreasing 0.2 percent on month and rising 2.4 percent on

year in December. Grocery prices and distortions from last year's tax holiday

expected to bias the numbers higher.

Canada Manufacturing Sales for January (Mon 0830 EST;

Mon 1330 GMT)

Consensus Forecast, CPI - M/M: 0.5%

Consensus Range, CPI - M/M: 0.5% to 0.6%

Forecasters agree with Statistics Canada's advance estimate

calling for sales up 0.5 percent, paced by food and auto sales.

Germany CPI for January (Tue 0800 CET; Tue 0700 GMT; Tue

0200 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.1%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.1% to 2.1%

CPI expected unrevised in the revision from the flash report

showing CPI up 0.1 percent on month and 2.1 percent on year in January.

UK Labour Market Report for February (Tue 0700 GMT;

Tue 0200 EST)

Consensus Forecast, ILO Unemployment Rate: 5.1%

Consensus Range, ILO Unemployment Rate: 5.1% to 5.2%

ILO unemployment is seen flat at 5.1 percent in February from

January.

Germany ZEW Survey for February (Tue 1000 CET; Tue

0900 GMT; Tue 0400 EST)

Consensus Forecast, Current Conditions: -67.5

Consensus Range, Current Conditions: -73.7 to -64.0

Consensus Forecast, Economic Sentiment: 65

Consensus Range, Economic Sentiment: 57 to 65

Sentiment expected to continue recovering with current

conditions up to minus 67.5 from minus 72.7 in January.

US Empire State Manufacturing Index for February (Tue

0830 EST; Tue 1330 GMT)

Consensus Forecast, Index: 7.0

Consensus Range, Index: 2.0 to 10.1

The consensus sees the index nearly unchanged at 7.0 for

February versus 7.7 in January. That suggests continued modest growth.

US Housing Market Index for February (Tue 1000 EST;

Tue 1500 GMT)

Consensus Forecast, Index: 38

Consensus Range, Index: 37 to 41

Homebuilder sentiment is expected to remain relatively

depressed in February with the NAHB index at 38 versus 37 in January. In

January 2025 the index stood at 47.

Japan Merchandise Trade for October (Wed 0850 JST;

Tue 2350 GMT; Tue 1850 EST)

Consensus Forecast, Balance: ¥-2,211.45 B

Consensus Range, Balance: ¥-2,461.70 B to ¥-1,776.80.74

B

Consensus Forecast, Imports - Y/Y: 3.1%

Consensus Range, Imports - Y/Y: -2.4% to 7.0%

Consensus Forecast, Exports - Y/Y: 11.9%

Consensus Range, Exports - Y/Y: 4.9% to 14.5%

Japanese export values are expected to grow for a fifth

straight month in January, supported by increases in semiconductor-related

electronic components, ships and nonferrous metals. Still, the country's trade

balance is seen slipping into deficit for the first time in three months.

Exports are projected to rise 11.9 percent from a year

earlier in January, following a 5.1 percent increase in December. Export values

may have risen in early to mid-January, as some shipments were likely

front-loaded in Asia ahead of the Lunar New Year in February.

Imports are also expected to rise for a fifth straight

month, gaining about 3.1 percent on the year in January after a revised 5.2

percent increase in December. January's import growth is seen driven by

semiconductor-related electronic components, nonferrous metals and crude oil.

Although crude oil import prices fell in early to mid-January, higher import

volumes helped lift overall import values.

As a result, the customs-cleared trade balance is expected

to swing into a deficit for the first time in three months, estimated at ¥2.2136

trillion in January, following a revised surplus of ¥113.5 billion in December

and a ¥2.74 trillion deficit in January 2025.

Australia Wage Price Index for April (Wed 1130 AET;

Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.7% to 0.9%

Consensus Forecast, Y/Y: 3.4%

Consensus Range, Y/Y: 3.4% to 3.4%

Wages seen up 0.8 percent on quarter and 3.4 percent on year

in Q4 after the same increases of 0.8 percent and 3.4 percent in Q3.

New Zealand RBNZ Announcement (Wed 1400 NZDT; Wed

0100 GMT; Tue 2000 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 2.25%

Consensus Range, Level: 2.25% to 2.25%

The consensus looks for no action from the RBNZ this time

after a series of rate cuts. Policy-makers are back in wait and see mode but

there's lots of focus on the assessment of the economy and what it suggests

about the timing of future interest rate cuts.

UK CPI for January (Wed 0700 GMT; Wed 0200 EST)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -0.5% to -0.1%

Consensus Forecast, Y/Y: 3.0%

Consensus Range, Y/Y: 2.9% to 3.1%

CPI seen down 0.5 percent on month and up a more moderate 3.0

percent on year in January versus increases of 0.4 percent and 3.4 percent in

December.

France CPI for January (Mon 0845 CET; Mon 0745 GMT; Mon

0245 EST)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -0.4% to 0.1%

Consensus Forecast, Y/Y: 0.3%

Consensus Range, Y/Y: 0.3% to 0.4%

Consensus Forecast, HICP - M/M: -0.4%

Consensus Range, HICP - M/M: -0.4% to -0.4%

Consensus Forecast, HICP - Y/Y: 0.4%

Consensus Range, HICP - Y/Y: 0.4% to 0.4%

CPI expected unrevised in the final from the flash report

showing CPI down 0.3 percent on month and up 0.3 percent on year in January.

US Durable Goods Orders for December (Wed 0830 EST;

Wed 1330 GMT)

Consensus Forecast, New Order - M/M: -2.3%

Consensus Range, New Order - M/M: -5.1% to 1.0%

Consensus Forecast, Ex-Transportation - M/M: 0.3%

Consensus Range, Ex-Transportation - M/M: 0.2% to 0.4%

Consensus Forecast, Core Capital Goods - M/M: 0.2%

Consensus Range, Core Capital Goods - M/M: 0.1% to

0.2%

Durable goods orders expected to decrease 2.3 percent on the

month in December reflecting a drop in Boeing aircraft orders. The consensus

sees an increase of 0.3 percent ex-transportation orders. Core capital goods

orders are seen up 0.2 percent.

US Housing Starts and Permits for November (Wed 0830

EST; Wed 1330 GMT)

Consensus Forecast, Starts - Annual Rate: 1.325 M

Consensus Range, Starts - Annual Rate: 1.310 M to 1.350

M

Consensus Forecast, Permits - Annual Rate: 1.345 M

Consensus Range, Permits - Annual Rate: 1.310 M to 1.370

M

The call for November is a 1.325 million unit rate. Permits

are seen at a 1.345 million unit rate.

US Housing Starts and Permits for December (Wed 0830

EST; Wed 1330 GMT)

Consensus Forecast, Starts - Annual Rate: 1.310 M

Consensus Range, Starts - Annual Rate: 1.290 M to

1.350

Consensus Forecast, Permits - Annual Rate: 1.400 M

Consensus Range, Permits - Annual Rate: 1.310 M to 1.425

M

Forecasters see December starts at 1.31 million rate and

permits at 1.40 million. The Census Bureau is scheduled to release the delayed

November report at the same time as December's.

US Industrial Production for January (Wed 0915 EST; Wed

1415 GMT)

Consensus Forecast, Industrial Production - M/M: 0.4%

Consensus Range, Industrial Production - M/M: -0.2%

to 0.6%

Consensus Forecast, Manufacturing Output - M/M: 0.2%

Consensus Range, Manufacturing Output - M/M: 0.2% to

0.7%

Consensus Forecast, Capacity Utilization Rate: 76.5%

Consensus Range, Capacity Utilization Rate: 76.0% to

76.7%

IIP seen up again by 0.4 percent for January after rising

0.4 percent in December.

Japan Machinery Orders for December (Thu 0850 JST; Wed

2350 GMT; Wed 1850 EST)

Consensus Forecast, M/M: 3.2%

Consensus Range, M/M: 1.0% to 5.0%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: -0.5% to 4.4%

Japan's core machinery orders, a key leading indicator of

business investment in equipment and software, are expected to rise from the

previous month for the first time in two months in December, supported by solid

capital spending sentiment and persistent demand for computers as firms

digitalize and automate workplaces to ease labor shortages.

Core machinery orders are forecast to increase 3.29

percent from the previous month in December, rebounding from an unexpectedly

sharp 11.0 percent drop in November. In November, orders were weighed down by

declines in nuclear power-related orders from nonferrous metals and electric

machinery producers, as well as weaker demand for train cars and engines from

transport firms.

On a year-on-year basis, core orders, excluding those from

electric utilities and for ships, are expected to rise 1.02.2

percent in December, after falling 6.4 percent a month earlier. The November

decline marked the first annual drop in 14 months.

Australia Labour Force Survey for January (Thu 1130

AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Employment - M/M: 21K

Consensus Range, Employment - M/M: -5K to 40K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.1% to 4.3%

The consensus sees jobs up 21K for January after rising a

large 65K in December. The unemployment rate is expected to tick up to 4.2

percent versus 4.1 percent in December.

Canada Merchandise Trade for December (Thu 0830 EST;

Thu 1330 GMT)

Consensus Forecast, Balance: -C$2.0 B

Consensus Range, Balance: -C$2.4 B to -C$1.4 B

The consensus sees another deficit of C$2.0 billion in

December after a C$2.197 billion deficit in November.

United States International Trade in Goods and Services

for December (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Balance: -$55.8 B

Consensus Range, Balance: -$61.5 B to -$50.0 B

Forecasters expect the trade gap up at $55.8 billion for

December compared with $56.8 billion in November.

US Jobless Claims for Week2/14 (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Initial Claims - Level: 225 K

Consensus Range, Initial Claims - Level: 204 K to 229

K

Claims expected nearly flat at 225K versus 227K in the

previous week.

US Philadelphia Fed Manufacturing Index for February (Thu

0830 EST; Thu 1330 GMT)

Consensus Forecast, Index: 7.7

Consensus Range, Index: 5.0 to 12.2

The consensus looks for an index at 7.7 in February

suggesting ongoing modest expansion in manufacturing business versus 12.6 in

January.

US Pending Home Sales Index for January (Thu 1000

EST; Thu 1500 GMT)

Consensus Forecast, M/M: 2.5%

Consensus Range, M/M: 0.2% to 6.5%

Pending home sales are seen rebounding by 2.5 percent in

January after dropping 9.3 percent in December.

Japan CPI for January (Fri 0830 JST; Thu 2330 GMT;

Thu 1830 EST)

Consensus Forecast, CPI - Y/Y: 1.6%

Consensus Range, CPI - Y/Y: 1.5% to 1.7%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.1%

Consensus Range, Ex-Fresh Food - Y/Y: 2.0% to 2.1%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

2.7%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.6%

to 2.8%

Japan's nationwide consumer inflation is expected to

continue rising, but the pace of gains is seen slowing further in January after

sharp declines across the three key measures the previous month, as softer food

and energy prices, along with lower electricity and gas prices, weighed on

inflation growth.

The core consumer price index (CPI), which excludes fresh

food, is expected to rise 2.1 percent from a year earlier in January, marking a

53rd consecutive increase but the slowest pace since January 2024. The CPI

stood at 2.4 percent in December and had eased from 3.0 percent in both October

and November.

Among the other major measures, the headline CPI is

projected to rise about 1.6 percent in January, slowing for a third straight

month from 2.14

percent in December and slipping below the Bank of Japan's inflation target.

The core-core CPI, which excludes both fresh food and energy, is expected to

rise about 2.78

percent, down from 2.9 percent in December, when it fell below the 3 percent

mark for the first time in nine months since March.

UK Retail Sales for January (Fri 0700 GMT; Fri 0200

EST)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.1% to 0.3%

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 2.1% to 2.8%

Sales expected up 0.3 percent on the month and 2.4 percent

on year in January after rising 0.4 percent and 2.5 percent in December.

France PMI Composite Flash for February (Fri 0915

CET; Fri 0815 GMT; Fri 0315 EST)

Consensus Forecast, Manufacturing Index: 51.2

Consensus Range, Manufacturing Index: 50.9 to 51.6

Consensus Forecast, Services Index: 48.7

Consensus Range, Services Index: 48.6 to 49.5

Manufacturing PMI is seen at 51.2 in February flash versus

51.2 in January final. The services PMI is seen at 48.7 in February flash

versus 48.4 in January final.

Germany PMI Composite Flash for February (Fri 0930

CET; Fri 0830 GMT; Fri 0330 EST)

Consensus Forecast, Manufacturing Index: 49.8

Consensus Range, Manufacturing Index: 49.3 to 50.0

Consensus Forecast, Services Index: 52.5

Consensus Range, Services Index: 52.3 to 53.0

Manufacturing PMI is seen at 49.8 in February flash versus

49.1 in January final. The services PMI is seen at 52.5 in February flash

versus 52.4 in January final.

Eurozone PMI Composite Flash for February (Fri 1000

CET; Fri 0900 GMT; Fri 0400 EST)

Consensus Forecast, Composite Index: 51.4

Consensus Range, Composite Index: 51.3 to 52.0

Consensus Forecast, Manufacturing Index: 50.0

Consensus Range, Manufacturing Index: 49.5 to 50.5

Consensus Forecast, Services Index: 52.0

Consensus Range, Services Index: 51.6 to 52.3

The consensus sees the PMI composite flash at 51.4 in

February versus 51.3 in the January final. Manufacturing PMI is seen at 50.0 in

February flash versus 49.5 in January final. The services PMI is seen at 52.0

in February flash versus 51.6 in January final.

UK PMI Composite Flash for February (Fri 0930 GMT; Fri

0430 EST)

Consensus Forecast, Composite Index: 52.8

Consensus Range, Composite Index: 51.8 to 53.3

Consensus Forecast, Manufacturing Index: 51.4

Consensus Range, Manufacturing Index: 50.9 to 51.8

Consensus Forecast, Services Index: 53.0

Consensus Range, Services Index: 51.6 to 54.1

The consensus sees the PMI composite flash at 52.8 in

February versus 53.7 in the January final. Manufacturing PMI is seen at 51.4 in

February flash versus 51.8 in January final. The services PMI is seen at 53.0

in February flash versus 54.0 in the January final.

Canada Retail Sales for December (Fri 0830 EST; Fri

1330 GMT)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -0.5% to -0.5%

The consensus agrees with Stats Canada's preliminary

estimate at minus 0.5 percent on the month for January after the gain of 1.3

percent reported for December, led by food and beverage sales.

US GDP for Fourth Quarter (Fri 0830 EST; Fri 1330

GMT)

Consensus Forecast, Q/Q - Annual Rate: 2.8%

Consensus Range, Q/Q - Annual Rate: 1.7% to 3.6%

Consensus Forecast, Personal Consumption Expenditure -

Annual Rate: 2.4%

Consensus Range, Personal Consumption Expenditure -

Annual Rate: 2.4% to 2.7%

The initial estimate for Q4 is seen at a growth rate of 2.8

percent after 4.4 percent in Q3. PCE is expected at 2.4 percent after 3.5

percent in Q3.

US Personal Income and Outlays for December (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, Personal Income - M/M: 0.3%

Consensus Range, Personal Income - M/M: 0.1% to 0.7%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.3%

Consensus Range, Personal Consumption Expenditures - M/M:

0.0% to 0.5%

Consensus Forecast, PCE Price Index - M/M: 0.3%

Consensus Range, PCE Price Index - M/M: 0.3% to 0.4%

Consensus Forecast, PCE Price Index - Y/Y: 2.8%

Consensus Range, PCE Price Index - Y/Y: 2.8% to 2.9%

Consensus Forecast, Core PCE Price Index - M/M: 0.3%

Consensus Range, Core PCE Price Index - M/M: 0.2% to

0.4%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.9%

Consensus Range, Core PCE Price Index - Y/Y: 2.8% to

3.0%

Spending is expected at up 0.3 percent and income at 0.3

percent in the delayed report for December. Core PCE prices are expected up 0.3

percent, an unpleasant outcome for anyone hoping for more aggressive rate cuts.

US PMI Composite Flash for February (Fri 0945 EST; Fri

1445 GMT)

Consensus Forecast, Manufacturing Index: 51.9

Consensus Range, Manufacturing Index: 51.8 to 52.1

Manufacturing PMI is seen at 51.9 in February flash versus

52.4 in the January final.

US New Home Sales for November (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Annual Rate: 735K

Consensus Range, Annual Rate: 710K to 745K

US New Home Sales for December (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Annual Rate: 728K

Consensus Range, Annual Rate: 690K to 755K

The delayed reports are expected to show sales at an annual

735K rate in November and 728K rate in December.

US Consumer Sentiment for February (Fri 1000 EST; Fri

1500 GMT)

Consensus Forecast, Index: 57.0

Consensus Range, Index: 54.3 to 57.3

The final February report is expected to show sentiment

index at 57.0 versus 57.3 in the preliminary February report compared with 56.4

in January final and a much stronger 64.7 a year ago.

|